| Editor’s Note: With each forecasting issue, we offer the Congressional Budget Office’s (CBO) assessment and projection for the coming year. Most accept the assumption that the CBO is nonpartisan in its analysis of the U.S. budget and economy. While you may not agree with their assumptions and projections, it is important to recognize how the macro issues of the economy might have an impact on your business. This report by the CBO presents an analysis of the proposals contained in the President’s budget request for fiscal year 2016. The report, titled An Analysis of the President’s 2016 Budget can be found at www.cbo.gov/publication/49979. |

This report by the CBO presents an analysis of the proposals in the President’s budget request for fiscal year 2016. The analysis is based on CBO’s economic projections and estimating models (rather than on the Administration’s), and it incorporates estimates of the effects of the President’s tax proposals that were prepared by the staff of the Joint Committee on Taxation (JCT).

What Is Projected to Happen to Federal Deficits and Debt Under Current Law?

In conjunction with analyzing the President’s budget, CBO has updated its baseline budget projections, which were previously issued in January 2015. Those projections largely reflect the assumption that current tax and spending laws will remain unchanged; they thereby provide a benchmark against which the President’s proposals and other potential legislation can be measured.

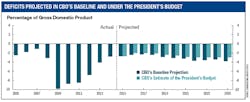

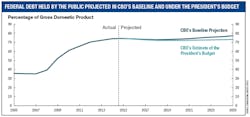

According to CBO’s current baseline projections, under current law, the federal deficit will be $486 billion in 2015 and the cumulative deficit over the 2016–2025 period will total $7.2 trillion. The deficit is projected to be 2.7 percent of gross domestic product (GDP) in 2015, to decline to 2.4 percent of GDP in 2016 and remain at about that level for the next two years, and then to increase relative to the size of the economy, reaching 3.8 percent of GDP in 2025. Federal debt held by the public, which amounted to 74 percent of GDP at the end of 2014, is projected to reach 77 percent of GDP in 2025; it was less than 50 percent of GDP in every year between 1957 and 2008.

How Would the President’s Proposals Affect Federal Deficits and Debt?

The President’s budget request specifies spending and revenue policies for the 2016–2025 period and includes a few initiatives that would have budgetary effects in fiscal year 2015 as well. CBO and JCT estimate that if enacted, the President’s proposals would have no significant net effect on the deficit in 2015 but would reduce deficits relative to those in CBO’s baseline in each year between 2016 and 2025. Specifically, the President’s policies are estimated to have the following consequences:

- For 2015, the deficit would total $486 billion, equal to the deficit projected under current law. Under the President’s policies, the deficit would fall to $380 billion in 2016 and then increase (in nominal dollars) in each subsequent year of the 10-year period, growing to $801 billion in 2025.

- Measured relative to the size of the economy, the deficit would equal 2.7 percent of GDP in 2015. It would then dip to around 2.0 percent of GDP for the next few years before increasing in the last half of the decade to 2.9 percent; it has averaged 2.7 percent of GDP over the past 50 years.

- Deficits would be smaller than those in CBO’s baseline each year from 2016 through 2025. In all, deficits would total $6.0 trillion over that period, $1.2 trillion less than the cumulative deficit in CBO’s baseline. By 2025, the deficit relative to GDP under the President’s budget would be nearly 1 percentage point lower than the deficit in CBO’s baseline.

- Federal debt held by the public would remain in the vicinity of 72 percent or 73 percent of GDP throughout the next decade. By the end of 2025, it would total $20.1 trillion (or 73 percent of GDP), about $1 trillion (or 4 percent of GDP) less than the debt projected in CBO’s baseline for that year.

What Proposals Would Have the Largest Budgetary Effects?

The estimated net reduction in the deficit of $1.2 trillion between 2016 and 2025 under the President’s proposals relative to CBO’s baseline consists of the following elements:

- A reduction in funding for military operations and related activities in Afghanistan and elsewhere that are designated as overseas contingency operations. Following the rules specified in law, CBO’s baseline incorporates the assumption that in each year through 2025, funding for such operations will equal the amount provided in 2015 – $74 billion – with modest increases to keep pace with inflation. By comparison, the President’s budget includes a request for $58 billion for those operations in 2016, a placeholder amount of $27 billion in each year from 2017 through 2021, and nothing thereafter. Consequently, estimated outlays for overseas contingency operations under the President’s proposal are $532 billion less over the 2016–2025 period than those in CBO’s baseline.

- An increase in income tax receipts from limiting the extent to which taxpayers can reduce their tax liability through certain deductions and exclusions. The President proposes to cap the reduction in tax liability resulting from certain deductions and exclusions at 28 percent of the amount of those deductions and exclusions. That change would increase revenues by $526 billion over the next decade, JCT estimates.

- Reductions in spending for Medicare. Taken together, the proposed changes to Medicare in the President’s budget (excluding those related to repealing the automatic enforcement procedures known as sequestration) would decrease federal spending by $240 billion over the 10-year projection period. The President’s proposal to increase payment rates for physicians (which, under current law, are scheduled to be lowered in 2015) would boost outlays by $6 billion in 2015 and by $168 billion between 2016 and 2025. However, the President’s other proposals affecting Medicare would reduce outlays by $408 billion.

- Net savings from comprehensive immigration reform similar to the legislation that was passed by the Senate in 2013—S. 744, the Border Security, Economic Opportunity, and Immigration Modernization Act. In July 2013, CBO and JCT estimated that enacting that legislation would increase the number of legal residents and the size of the labor force, which would boost both tax receipts and spending for federal benefit programs and have various other economic and budgetary effects. Over the 2014–2023 period, according to CBO and JCT’s estimates, enacting S. 744 in 2013 would have produced a net reduction in the deficit of $158 billion.

For the purposes of this analysis, CBO and JCT have updated their estimates of the budgetary effects of that legislation to incorporate changes to CBO’s baseline, including changes to average per capita benefits for certain programs and the effects of the Administration’s deferred action programs for unauthorized immigrants. CBO and JCT now estimate that enacting such legislation would reduce deficits by $173 billion, on net, over the 2016–2025 period, raising revenues by $423 billion and increasing mandatory spending by $250 billion. - An increase in discretionary spending for all activities other than overseas contingency operations and surface transportation programs (which the President proposes to reclassify to the mandatory side of the budget). In total, projected outlays for those activities under the President’s budget are $371 billion (or 3 percent) more over the 10- year projection period than those in CBO’s baseline. The proposed increases in appropriations would be made possible by raising the caps on discretionary funding through 2021 relative to what they would be under current law. (Those caps would also be extended through 2025.) Under the President’s budget, outlays for defense activities, other than those related to overseas contingency operations, would increase by $193 billion over the 2016–2025 period relative to CBO’s baseline. For nondefense discretionary programs (excluding those related to surface transportation and overseas contingency operations), outlays would be about $178 billion higher over the decade.

- A net increase in revenues stemming from other proposals. The President’s budget includes a number of other proposed changes that would boost revenues by $831 billion, on net, over the 2016–2025 period. Among the largest changes are proposals to increase taxes on capital gains and dividends ($230 billion), to impose a onetime tax on certain foreign earnings ($210 billion), and to modify estate and gift taxes ($153 billion).

- A net increase in noninterest spending stemming from other proposals. All other proposals in the President’s budget would boost outlays by $852 billion, on net, over the 10-year period. The President’s proposals to modify various refundable tax credits would increase outlays by $264 billion, and proposals related to education and job training would increase spending over the next decade by $178 billion, CBO estimates. Cancelling the automatic reductions in mandatory spending would boost outlays by $120 billion through 2025.

- Savings on interest payments. Between 2016 and 2025, the policy changes proposed in the President’s budget would increase revenues by $1.8 trillion (or about 4 percent) and increase noninterest outlays by about $700 billion (or about 2 percent), according to CBO and JCT estimates. That reduction in deficits of $1.1 trillion would diminish federal borrowing relative to what CBO projects would occur under current law and thereby decrease the government’s interest payments by an estimated $153 billion over the 10-year period, putting the cumulative deficit $1.2 trillion below CBO’s baseline total.