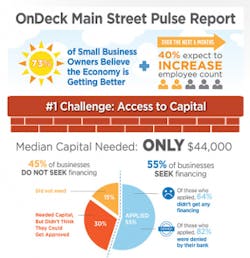

OnDeck, the technology-powered Main Street lender, announced in January that it had realized record annual revenue growth of 150% in 2013, combined with an annualized run rate of $100 million in revenue. On the heels of that news, the company released the January 2014 edition of its Main Street Pulse Report, with the news that OnDeck’s loan volume had surpassed $825 million in capital delivered to Main Street since the company’s inception.

Owen Linderholm, in Profit Minded, said OnDeck expects to have delivered $1 billion in capital to main street small businesses by the mid-March 2014. He added that the type of loan that OnDeck offers has significant advantages, such as speed for approval and delivery of funds and loans for a wider range of businesses that qualify, especially smaller businesses), Disadvantages include higher interest rates and limits on the amount that can be borrowed.

Sources for the lender say the company’s strong performance reflects its focus on innovative technology and credit models, superior marketing strategies and aggressive hiring efforts. Other milestones found in the Report include:

140% year-over-year increase in customers served“Our momentum is a result of our team’s flawless execution and our ability to better identify creditworthy small businesses through technology,” said Noah Breslow, chief executive officer, OnDeck. ”OnDeck’s 150% revenue jump in 2013 demonstrates both the high quality of our disruptive solution to a flawed traditional lending system, and the continued need small businesses have for lenders that can deliver fast and friction-free capital.”

Appearing on CNBC Squawk Box, Breslow said OnDeck's strength is found in its ability to collect thousands of electronic data points about small businesses across the U.S., and incorporates them into an algorithim it has developed to make efficient real-time lending decisions about a small business. Those data points include real-time cash flow and transactions, personal and business credit, public records and social media data.

"The business owner comes to website and be decisioned for up to $35,000, right online," Breslow said, in an interview with host Kellly Evans. "The traditional process at a bank can be very cumbersome and time-consuming for business owners. Small business owners are really really busy, hard to step away from the business; it can take 30-days on average to get a loan from a traditional bank. Our technology shortcuts all that, develops it using a big data approach, and makes it faster and more convenient for business owners out there."

About OnDeck

Launched in 2007, OnDeck uses data aggregation and electronic payment technology to evaluate the financial health of small and medium sized businesses and efficiently deliver capital to a market underserved by banks. Through the OnDeck platform, millions of small businesses can obtain affordable loans with a fraction of the time and effort that it takes through traditional channels. The company’s proprietary credit models look deeper into the health of businesses, focusing on overall business performance, rather than the owner’s personal credit history. The OnDeck system also provides a critically needed mechanism for financial institutions and other business service providers to efficiently reach the Main Street small business market.

OnDeck uses data aggregation and electronic payment technology to evaluate the

financial health of small and medium sized businesses and efficiently

deliver capital to a market underserved by banks.

OnDeck has deployed over $825 million in capital to tens of thousands of businesses across 725 different industries.

Positive Signs in Key Industries

The company’s Main Street Pulse Report identifies insights and drivers of increased growth capital demand. The study shows that OnDeck’s top three applicant categories achieved robust year-over-year increases in 2013:

- restaurants were up 102%;

- auto repair increased by 95%

- contractors and residential construction were up by 306%.

OnDeck believes this growth among community pillar industries represents the pent up demand for financing and the failure of traditional lenders to meet that demand.

This edition of the Main Street Pulse Report also saw a number of industries rebound from recession years, suggesting that small business activity – a significant driver of the US economy – will continue to grow in 2014. Highlights from the study include cyclical, seasonal, regional and industry-oriented observations. In Texas, for example, contractors and residential construction industries ave surpassed restaurants as the state's top small business growth industry. OnDeck sources believe that's a sign of a housing resurgence in Texas, which also experienced the nation's largest population growth year-over-year.

Other growth signs OnDeck believes point to a need for more small business lending include a 128% in loan applications from May to September 2013 for electronic shopping and mail-order house industries, and an 87% hike in loan applications for general freight trucking businesses.

In California, home health care provider applications increased 167% between July to December 2013.

Harnessing big data to determine the creditworthiness of a business, OnDeck’s lending platform has created a seamless system for small business owners to gain critical growth capital in a fast and efficient manner. Through the company’s technology, a credit decision can be made in minutes and funding delivered in as fast as 24 hours.

To learn more about OnDeck, visit www.ondeck.com.