Market dynamics are causing unprecedented interest in energy conservation. The Building Owners and Managers Association (BOMA) recently announced its 7 Point Challenge, with a goal of 30% reduction in energy use by 2012 as a key component. The American Society of Heating, Refrigerating, and Air conditioning Engineers (ASHRAE) and the U.S. Department of Energy have announced that they will work together to increase building energy efficiency standards for the year 2010, by 30% over 2004 standards.

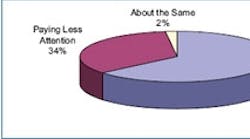

These initiatives are reflected in attitudes of company executives, and what they’re paying attention to. A recent survey by the Continental Automated Buildings Association (CABA) reported that nearly two-thirds of companies report paying more attention to energy conservation than they were a year ago. This interest in energy conservation is driven by three key trends:

- rising energy costs

- green / sustainability factors

- utility supply and demand.

Trend #1 – Rising Energy Costs

The law of supply and demand tells us that when something gets more expensive, people tend to buy less of it. But when it’s a necessity like energy that is increasing in price, it can be tough to cut back on the amount we buy. In fact, even while energy prices have significantly increased in recent years, energy usage in the commercial building sector has also been steadily increasing. The Energy Information Administration reports in its 2007 Annual Energy Outlook that commercial energy use per capita is projected to increase even more rapidly in the future, to levels 15 to 25% higher in 2030 than today.

However, energy consumption is only one part of the total energy cost equation. Energy prices make up the most significant part of the increases in the total cost of energy building owners and operators are facing. Electricity rates have risen 21.7% in just the past three years, from a national average of $0.0732 per kilowatt-hour (kWh) in December 2004 to $0.0891 per kWh in December 2007. But those rates, and the percentage increases experienced, vary widely across the country. In some states, the cost per kWh is more than twice the national average, having nearly doubled in this same timeframe.

Trend #2 – Green/Sustainability Factors

As the media, along with community and environmental groups, have been focusing on issues of carbon emissions and global climate change, the reaction of the business world has been to direct efforts towards sustainable business practices. From changing production materials to altering transportation methods, companies are looking to decrease their carbon footprint. Cutting energy use is one of the best ways for a company to make a big change to their carbon footprint.

What does this mean to you and your customers? Many companies in the U.S. are increasingly conscious of their energy use and carbon footprint. In the CABA survey, nearly one-half of companies said that they make investments in energy saving equipment for environmental reasons as well as cost reasons. Contrast this to just a few years ago, when cost savings were the only reason most companies made a change to energy systems.

Those companies who haven’t caught on to the trend might have to in the coming years; the U.S. may impose carbon emission reduction goals as local, national, and global political pressure builds. Whether through carbon taxes or a cap and trade system, the important concept to note is that in either approach, a second cost component to the use of energy is introduced. In addition to the cost of the energy (′ per kWh or $ per therm), there is now a direct economic cost of the carbon produced, which some day could rival the cost of the energy itself.

Trend #3 – Utility Supply & Demand

Utilities are in a bind. Demand for electricity continues to surge, with recent estimates projecting a 41% increase in demand by the year 2030, compared to 2005 usage. At the same time, the ability of utilities to increase supply is extremely limited. Plans for the construction of new coal fired or nuclear power plants are met with vigorous opposition by environmental groups and the local communities affected. Even projects using forms of renewable power generation, such as hydroelectric, face challenges due to potential environmental impacts.

While promising, renewable energy sources, such as wind or solar power, are expected to contribute no more than 3% of the total demand, even by the year 2030.

Energy conservation offers one of the best alternatives for utilities to meet customers’ expectations. Recognizing that it’s more feasible for utilities to incentivize conservation through rebate programs than to aggressively pursue even greater increases in energy supplies, many states have adopted an approach called decoupling. While there are many forms, decoupling essentially breaks the fundamental economic linkage between profit and volume, creating the ability for utilities to make equal or even greater profits by selling less gas and electricity.

A central theme to these programs is for a utility to reward those customers who decrease their energy use.

Commercial consumers, as the biggest customers of utilities, have a lot to gain from conserving their energy use. Not only will they cut costs, but they have the chance to claim rebates from utilities, to share the cost of capital improvements, and to earn incentive bonuses from utility companies — in addition to their savings.

How to Profit from These Trends

The factors discussed above are coming together to create new opportunities for contractors that can help their customers identify and implement energy conservation measures. Specifically, building on their base of service agreements, contractors are uniquely suited to serve new markets that are forming around improving the energy efficiency in existing buildings.

However, new ideas will be required to expand the focus of high performance buildings beyond new construction to maximize the opportunity — both in revenue for contractors providing these new energy services, as well as the total reduction in energy consumption. Here are three key areas on which to focus:

Think Small

The current base of commercial buildings is skewed toward small and medium sized buildings. Over 90% of all commercial buildings are less than 25,000 sq.ft. Ninety-eight percent of all commercial buildings are less than 100,000 square feet. These buildings consume nearly 60% of the total energy used in all commercial buildings.

The result is that the existing buildings segment remains a tremendously underserved market. If, as a country, we are serious about reducing energy consumption and our carbon footprint, then, as an industry, we must address the full stock of existing buildings. A broad base of service providers will be needed to serve the vast numbers of small and medium sized buildings.

This bodes well for contractors who are able perform energy diagnostics.

Develop Processes that Scale

The typical process for completing a retrocommissioning study or energy audit requires the firm to invest 20 to 40 hours of skilled engineering time to qualify the opportunity and scope the complete audit project. This creates capacity and scale issues for contractors, in that they can afford to commit resources only to large scale projects where the implementation phase will help recover the high cost associated with early stages of the audit process.

Only about 10% of buildings less than 100,000 sq.ft. have a building automation system. The sheer numbers of small and medium sized buildings, combined with poor access to data about them, make traditional processes for selling and executing commissioning difficult. The winners will be the firms that can see the coming market opportunity — and plan for it by building processes, developing resources, and enabling scale.

Simplifying the sales process, including:

- access to real building data

- qualifying the opportunity

- the skill set of on-site personnel required

- energy analysis and modeling

- return on investment analysis, and

- reporting and sales presentation, will help build the high-volume business model necessary to begin to fully address the building market segment.

Utility Programs as a Catalyst

The majority of utilities have established programs to pay a high percentage of the cost of an energy assessment. Most of the utilities with programs list firms on their web site as a “qualified” provider of energy assessment services. But few contractors have built specific marketing programs to use the utility programs as a catalyst to drive business.

A large, untapped business opportunities for contractors is to bring together the three elements discussed here — a focus on smaller buildings, that will require scalable processes, and leverage utility programs — to create an energy assessment service that can address this underserved market.

To grow your service business, build a strategy around rebate programs available in the markets you serve, and market a specific offering that meets the requirements of those programs. This will lead to greater retrofit controls and equipment sales.

Information in this article was based on the Commercial Buildings Energy Consumption survey, provided by AirAdvice, Portland, OR, and edited by Contracting Business. The BuildingAdvice™ program from AirAdvice provides energy diagnostic solutions to mechanical service and controls contractors. Visit www.airadvice.com/commercial.php for additional information.