There’s a gem in the Tax Cuts and Jobs Act that President Trump signed on December 22, 2017. I’m talking specifically about the changes to Section 179 of the tax code. Up until this year, this special deduction for business property owners was limited to mostly business-use vehicles and non-fixture equipment inside a commercial building. This included office equipment, machinery, computers, etc.

Prior to this change, HVAC equipment was considered a capital improvement to the building and excluded from the Section 179 deduction. This meant it had to be depreciated over 39 years. The new Section 179 deduction can now be applied to both new and used HVAC equipment purchases up to $2.5 million, with a $1 million deduction limit.

What Does This Mean to You as an HVAC Contractor?

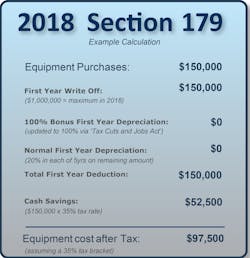

Let’s say you are working with a building owner who needs 10 new rooftop units and system renovations totaling $150,000. Prior to this new tax benefit, with a 39-year depreciation, assuming a 35% tax bracket, your customer would have been able to only claim a $3,846 first-year depreciation and only save about $1,346 in taxes.

Today, that same owner can now fully deduct the $150,000 purchase for a tax reduction of $52,500! See the table below for the computation. Of course, always make sure your customers check with their tax professional for exact details on these new deductions as well as information on bonus depreciation on larger purchases.

This new law will help our industry sell a lot of HVAC systems this year, as owners will be more easily convinced to invest now and take advantage of a deduction that greatly reduces their initial investment. Be sure to include this important information in all your presentations and proposals ASAP!

Another impetus to getting the work done this year is there are no assurances on what happens after 2018. Section 179 has been known to vary widely over the years. In 2007, for example, the maximum deduction was just $125,000.

What also varied from year to year was the type of equipment eligible for Section 179. This is the first year HVAC qualifies, and hopefully will continue to, but there are no guarantees the code will be this generous in future years.

Finally, if you have been putting off making these types of improvements in your own building, don’t put it off! Now is the time to make the investment and maximize your tax benefits. As always, be sure to consult with your tax professional for your best tax benefit. For more details on Section 179 for 2018 go to: bit.ly/UnderstandingSec179