As many accurately predicted this time last year, 2011 saw little concrete movement at the federal level regarding legislation affecting the HVACR industry, although there were definitely some interesting developments in the regulatory world — especially from the Department of Energy.

While the full impact of the regional standards for air conditioning and heating equipmenat, as well as the Workforce Guidelines for Home Energy Upgrades, have yet to be felt, those regulations only further contribute to the economic activity anticipated in 2012.

Clearly, energy efficiency and environmental impact are primary drivers for improvements and enhancements in equipment design, as evidenced by the formation of new "product sections" at the Air Conditioning, Heating and Refrigeration Institute (AHRI). The quest for gaining further efficiency from vapor compression mechanical refrigeration systems continues on a perpetual basis, such as in the realm of variable refrigerant flow air conditioning and heat pump systems.

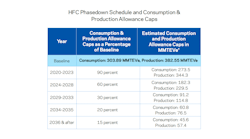

Similarly, the beginning of formal research assessing low Global Warming Potential Alternative Refrigerants Evaluation Program (Low GWP AREP) by AHRI signals the industry’s desire to objectively evaluate the next generation(s) of refrigerants in light of the desire to move from hydrofluorocarbons (HFCs) to refrigerants that have lower environmental impact. It would seem that the decades-long, firmly-held beliefs about refrigerants that aren’t designated A1 in ASHRAE’s refrigerant classification system are being re-evaluated in light of the overall "cost" of using chlorofluorocarbons (CFCs), hydro-chlorofluorocarbons (HCFCs) and HFCs.

The Environmental Protection Agency (EPA) has recently approved the use of certain hydrocarbons (HCs), through the Significant New Alternative Policy (SNAP) program. Though much more restrictive than use provisions in Europe, Asia and other parts of the world, the fact that these substances are usable as refrigerants, installation/service professionals (contractors and technicians alike) will need to be educated in their proper handling.

Based on attendance at Refrigeration Service Engineers Society (RSES) seminars and educational sessions at our annual conference — that focused on natural refrigerants such as CO2, ammonia, and hydrocarbons — interest is high from contractors and technicians seeking to learn the particulars regarding pressure/temperature relationships, coefficient of performance, and safe handling of these substances that are coming back into the mainstream.

Though purely anecdotal, the average consumer seems to be coming more and more aware that the choices they make regarding their comfort heating and cooling can have a significant impact on their personal economic performance. With new home construction still a long way from the heydays of the late 1990s and mid-2000s, and many homeowners seemingly staying put in their current homes, the opportunity to improve energy consumption is growing. More homeowners are content with their present residence and increasingly interested in making it as cost-effective and energy efficient as possible.

Similarly, more business owners are increasingly looking at the "big picture" of equipment life-cycle cost including the operating costs instead of just running systems to the point of failure. Although refrigeration system owners have been ahead of the game given the critical nature of those systems to their business models, more property owners are evaluating system repair versus replacement and considering higher-efficiency systems in order to achieve energy savings for commercial air conditioning and heating.

All these factors — industry and end-user initiated alike — are being noticed more and more by related stakeholders. For example, the Western HVAC Performance Alliance (WHPA; performancealliance.org) is ratcheting up its committee activity to provide the State of California with clear paths and recommendations to achieve the state’s desired Zero Net Energy (ZNE) goals.

A unique and ground-breaking collaboration between state oversight commissions, electrical utilities and the HVAC industry at large, the WHPA is building on its early successes of improved permit applications and endorsement of industry standards to address issues of contractor and technician competency.

Developing the workforce necessary to install, service and maintain both existing residential and commercial HVACR systems as well as new or replacement systems is integral to attaining California’s legislated energy efficiency targets. Although the industry is clear on the concept that comfort cooling and heating systems are not "plug-and-play," like a window air conditioner or refrigerator/freezer, establishing that understanding within the ranks of the regulating and legislating community finally seems to take hold.

Allowing anyone who wants to install, service or maintain equipment is not the best route to ensure the systems which consume the single largest percentage of energy (particularly electrical energy) are operating at their optimal design efficiency. The relevant state regulatory bodies are communicating through the efforts of the WHPA in California, and seem to be coming to that realization that changes need to be made through a variety of agencies in order to achieve the desired goals. And as so often is the case — if California comes to that enlightened state of mind, so too will the rest of the U.S. in time.

So, 2012 holds lots of promise for HVACR industry participants who are sufficiently positioned to provide energy efficient solutions and life-cycle cost effectiveness to their forward-thinking customers. The industry continues to pursue every last possible morsel of efficiency from the systems and components, and the legislative/regulatory community governing the industry slowly seems to be awakening to the practical manner in which it can impact the workforce tasked to implement every new design advance.

Mark Lowry is executive vice president, Refrigeration Service Engineers Society. He can be reached at 800-297-5660, x.4051; [email protected]

Ed.note: for a differing view on the prospects of net-zero energy, see http://bit.ly/michelonnetenergy

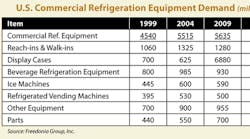

Commercial Refrigeration Equipment on a Big Rebound

Demand for commercial refrigeration equipment in the US is forecast to rebound through 2014, growing 5.6% per year to $7.4 billion.Demand in 2009 was drastically impacted by the U.S. recession, which caused food industry participants to postpone capital improvements and expansions. Advances will result from an improving capital investment outlook, as economic recovery encourages end users to renovate or expand existing facilities. Consumers’ busy lifestyles will continue to spur gains, as retailers offer a wider range of convenient, "grab and go" options, and a broader variety of frozen foods.

Demand for beverage refrigeration equipment and ice machines will benefit from the rising number of eating and drinking establishments. Display cases, especially models that offer mobility and flexibility, will post improved gains. Demand in all product categories serving food related markets will be strongest for equipment that is energy efficient, as companies throughout the entire food industry will seek to reduce operation costs. Rising medical research expenditures will spur demand for cryogenic equipment.

Shipments of commercial refrigeration equipment from U.S. facilities are forecast to rise 4.2% annually through 2014, reaching $6.5 billion. Advances will be limited by competition from imports both in domestic and export markets. The U.S. has become a net importer of commercial refrigeration equipment, reflecting a trend in the broader heating, ventilating and air-conditioning industry.

As would be expected given the large size of the local industry, the U.S. is home base of operations for several of the world’s leading commercial refrigeration equipment manufacturing concerns. Included among them are Dover (parent of Hill PHOENIX, Inc.), Lennox, Manitowoc, and United Technologies. Manitowoc’s 2008 acquisition of Enodis merged these two leaders into the third largest company in the industry. Most producers do not participate in all market segments, due largely to the wide range of applications in the industry. In addition, many of the leading foreign multinationals, such as Ingersoll-Rand and Hoshizaki, maintain production operations in the U.S. as well.

Source: Freedonia Group.The Freedonia Group is a leading international business research company, founded in 1985, that publishes more than 100 industry research studies annually. FreedoniaGroup.com

Ed. Note: In November 2011, Hill PHOENIX, Inc. expanded its portfolio of operating companies with Dover’s acquisition of Denmark-based Advansor A/S, a innovator in carbon dioxide (CO2) technology (http://bit.ly/HPadvansor). In January, 2011, Lennox International Inc. announced it had completed its purchase of the Kysor/Warren business from The Manitowoc Company, Inc.