Owners of HVAC and plumbing companies often take care of everyone else — employees and customers — and neglect some of the essential elements of taking care of themselves and their families. No, this column isn’t about you guys going to have a physical (although it is a great idea if you haven’t had one in over a year). Instead, this column is about the insurance that you have in place to take care of yourself, your family and your employees in case an unexpected accident, death or disability occurred.

Each month, I meet with a group of women involved in the HVAC and plumbing industry — both owners and managers. We recently discussed the issue of what happens to the business if the male owner becomes disabled for a period of time or for the duration. What happens if the male owner prematurely dies? Is a will in place? What happens to the business? What happens to the employees? Who will step into the management role? Is the business put into an automatic trust?

Not a cheery subject, but a necessary subject. The women in the group generally felt that this is a subject men don’t want to discuss or deal with. After all, who does. But women are most often left with the consequences if there are no plans. In spite of many changes in health care, working conditions, etc., women are still expected to live four years longer than men.

According to LexisNexis, only 55% of the American adult population have a will. And for those of you with young children, this is even more important than for us baby boomers. Who do you and your spouse want raising your children if something should happen to both of you?

Don’t quit reading if you say to yourself, ‘we have that taken care of. We have a buy/sell agreement; we have the business in a trust; the business carries key partner insurance on the owners of our partnership; our children won’t fight over the business.’ And all of these are good things, but any one of the preceding may not be enough.

According to the U.S. census Bureau, 18% of the U.S. population has some level of disability. Business owners don’t typically plan for the unexpected. Only 10% of HVAC and plumbing companies even create an annual business plan much less a plan for how the business will continue to operate upon the owner’s death or disability. However, with the help of a spouse, an attorney, insurance and perhaps a financial planner, the situation can be rectified.

Here is a list of 5 options from Small Business Law that you should consider. Implement those that make the most sense in your situation.

1) If your spouse is not in business or does not desire to take over the managerial role in the company, consider giving a key employee a limited power of attorney so that he or she has the authority to make decisions and continue business operations in the event of your incapacity.

2) Create an advisory committee with employees from your company who can be given the authority to make decisions by consensus.

3) Make sure you have a legal document that triggers the transfer of your business interests into a trust. The trust company could continue operating the business if you should die or become incapacitated. There are several types of trusts; do your homework and decide what’s best for your company.

4) Create a buy-sell agreement. This buy-sell agreement can be between shareholders, partners, or key managers. The agreement ensures that the shareholders, key managers or partners will purchase the business from your heirs.

5) Establish a board of directors. Allow them to make business operating decisions if you become incapacitated.

6) Analyze your personal and business insurance. Consider long-term disability and long-term care insurance for yourself and your employees.

7) Consider adding business disruption insurance. What if your business location was destroyed by fire or weather? Could the business weather a couple of months without sales and cash flow?

One other factor is critical: Create documented systems and procedures so that the business can continue to operate without you for an extended period of time. A contractor that we talk with often recently had to have a kidney transplant and his wife, who also works in the business, was his kidney donor. As a result, he has been out of the business for three months and his wife for approximately a month. How did he do it? He has the right people and the right systems and procedures in place so the business can effectively function without his everyday presence. Start planning now for how your business will survive, thrive and grow without your everyday presence. This business, after all, is an important part of your legacy.

Vicki LaPlant has worked with HVAC contractors for the past 30 years as a trainer/consultant. She helps people work better together for greater success. Vicki is a longtime Contracting Business.com editorial advisory board member and can be reached by e-mail at [email protected], or by phone at 903/786-6262.

Latest from Residential HVAC

Latest from Residential HVAC

Sponsored Content

Critical Challenges Facing HVACR Contractors in 2024

April 11, 2024

WINNER ANNOUNCED IN SERVICE BRACKET CHALLENGE!

April 5, 2024

Can Technology Address the Skilled Workforce Crisis?

Jan. 30, 2024

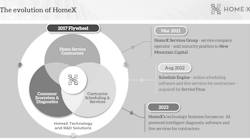

HomeX Plans More and Better Things for 2024

Jan. 3, 2024