As we welcome in the holidays, our thoughts turn to family visits, gifts, sleigh bells … and year-end tax planning! There were more than 300 changes made to the tax code in the American Recovery & Reinvestment Act of 2009 (commonly known as the “Stimulus Bill”). A number of provisions in previous bills were extended in the Stimulus Bill. However, a number of them expire on December 31, 2009.

Your Business Taxes

Section 179 Deduction

Typically, an asset purchased must be depreciated (written off) over a number of years. This deduction allows a business to immediately expense qualified property in the year it is bought. The limits for 2008 were extended through 2009.

The maximum Section 179 deduction is $250,000 and the maximum investment limit is $800,000. Amounts invested in excess of $800,000 will reduce the allowable deduction dollar for dollar from the $250,000 limit. Qualifying property includes items used in a trade or business. Some examples include machinery, equipment, vehicles (see the note below about luxury autos), furniture, and off-the-shelf computer software.

The Section 179 deduction is limited to the taxable income of the trade or business. Amounts not deductible in the current year because of the business income limitation are eligible to be carried forward to the next year. The $250,000 and $800,000 limits expire on December 31, 2009. The limits for 2010 are currently scheduled to drop to $133,000 and $530,000, respectively.

There are limits for luxury autos. The Section 179 deduction is limited to $25,000 for SUVs. The remaining purchase price is depreciated over five years.

“Bonus” Depreciation

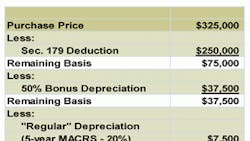

The 50% bonus depreciation provision was also extended by the Stimulus Bill. This provision allows a taxpayer to write off an additional 50% of the adjusted basis of property placed in service in 2009. The property purchased cannot be used. It must be new.

Figure 1 depicts a sample 2009 depreciation calculation. In this example, a contractor purchases $325,000 worth of equipment during 2009. The contractor was able to immediately expense $295,000 of the $325,000 purchased during the year on the tax return.

Section 199 Domestic Production Activities Deduction

This is a manufacturer's deduction that was created to encourage companies to keep production of their products in the U.S. The definition of “domestic production” under this section is so broad that it includes “construction of real property performed in the U.S.” Contractors installing comfort systems or plumbing systems in a home may be eligible for a deduction under this section. The deduction was to increase to 9% for 2010. However, that increase has been revoked, so the deduction will stay at 6%. This is a very complex section of the tax code. Talk to your CPA about its applicability to your situation.

Work Opportunity Tax Credit

This credit allows a business to claim a credit equal to 40% of the first $6,000 of wages paid to employees in a “targeted group.” The employee must work more than 400 hours during the year; otherwise, the credit is reduced to 25% for those who work at least 120 hours during the year. There are nine targeted groups. For the complete list of targeted groups, visit the U.S. Department of Labor website.

“S” Corporation Built-In Gains (BIG) Tax

The BIG tax was enacted to keep “C” corporations from converting to “S” corporations solely to avoid taxes on appreciated property that would result in taxable gains if sold.

The BIG tax rate is the maximum corporate tax rate (currently 35%) at the time of the transaction (sale of property.) For 2009 and 2010, an “S” corporation is not subject to the BIG tax if the “C” corporation elected “S” status prior to 2002 for 2009 (prior to 2003 for 2010).

The Stimulus Bill reduced the holding period from 10 to seven years. So, if your company is an “ S” corporation that converted from a “C” corporation prior to 2002, you can sell appreciated property without the fear of having to pay the BIG tax.

Your Personal Taxes

American Opportunity Education (AOE) Tax Credit

(Formerly the HOPE scholarship credit.) The Stimulus Bill has increased and expanded the educational tax credit. For 2009 and 2010, the credit is 100% of the first $2,000 of qualified educational expenses plus 25% of the next $2,000 of qualified expenses. The maximum credit amount is $2,500 per student per year, and the credit now applies to the first four years of post-secondary education. The credit starts phasing out for taxpayers with an adjusted gross income (AGI) of $80,000 (single) or $160,000 (married).

Page 2 of 2

Tuition Deduction

For taxpayers who don't qualify for the AOE Tax Credit, there is a deduction allowed for up to $4,000 of tuition and fees paid to an accredited post-secondary school. The deduction is not available to those with an AGI over $80,000 (single)/$160,000 (married).

Estimated Tax Payments — Small Business Owners

For 2009, the “safe harbor” provision for taxpayers in order to avoid underpayment penalties has been expanded. Taxpayers can avoid the penalty if the taxpayer has withheld or makes estimated tax payments totaling 90% of the previous year's tax return. It was 100% under the old law. The taxpayer's AGI must have been less than $500,000 and more than 50% of the gross income on the previous year's return must have come from the small business. This provision doesn't apply to “C” corporations.

Sales vs. Income Tax Deduction

You are allowed to deduct state and local sales taxes paid instead of state and local income taxes if you choose. This would be most beneficial in states with no income taxes, such as Florida and Texas.

Sales Tax Deduction on Vehicles

For vehicles purchased from February 18th through December 31st, 2009, you can deduct state and local sales taxes on the purchase. The vehicle purchase price cannot exceed $49,500. Vehicles with a gross vehicle weight (GVW) that qualify include passenger autos, light trucks, and motorcycles. Motor homes also qualify with no GVW restrictions. You can take this deduction whether you itemize your deductions or not. The deduction phases out for those whose modified AGI is over $125,000 (single)/$250,000 (married).

Additional Standard Deduction

For 2009, an additional standard deduction amount is available to those who pay real estate taxes and who don't itemize. The amount is the lesser of the state and local real estate taxes paid during the year, or $500 (single)/$1,000 (married).

First-time Homebuyer's Credit

This credit was expected to end on November 30, 2009. It allowed those who hadn't owned a home in the U.S. during the previous three-year period prior to buying the home a tax credit equal to 10% of the purchase price up to $8,000. The home had to be purchased (and closed) between January 1, 2009 and November 30, 2009. At press time, Congress was discussing extending and possibly expanding this credit.

These are just some of the deductions and credits available to you and your business. It's not too late to take advantage of many of these ideas. You have until December 31, 2009. Talk to your CPA or tax advisor to discuss your specific situation.

U.S. Treasury Department Circular 230 Disclosure: To ensure compliance with requirements imposed by the IRS, we inform you that, unless expressly stated otherwise, any U.S. federal tax advice contained in this communication (including any attachments) is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding penalties under the Internal Revenue Code or (ii) promoting, marketing or recommending to another party any transaction or matter addressed herein. This article is not intended to be comprehensive in nature and competent professional tax advice should be sought in determining the issues that impact your specific situation.

Michael A. Bohinc is a certified public accountant in Cleveland, OH. He is also a licensed HVAC and plumbing contractor in the State of Ohio. He is a Consult & Coach Partner for the Service Roundtable. He has more than 20 years experience working on business management issues in the HVAC and plumbing industries. Bohinc can be reached at: 440/708-2583, e-mail [email protected].