AEC Proposals Inked Beyond Belief in 2Q

NEWTON, Massachusetts, July 8, 2021 – Proposal activity for architectural, engineering and construction firms (AEC) continued to grow at what was described as a "torrid" pace in the second quarter of 2021, according to PSMJ Resources’ Quarterly Market Survey.

The survey’s net plus/minus index (NPMI) of 52 percent for overall proposal activity was the highest in any second quarter in the 18-year history of the survey and the fifth highest all-time for any quarter. Revenue and backlog indicators were also at or near record-high rates in the survey of PSMJ member firms.

“The increase in A/E industry revenues that began in Q1 of this year has accelerated significantly in Q2, as has the increase in backlog,” says PSMJ Senior Principal David Burstein, PE, AECPM. “Looking to the future, proposal opportunities again grew at a rapid pace in Q2 in almost all markets. Even some markets that have been soft seem to have reached bottom and are likely to improve in the coming quarters. These include hospitality, office buildings, resource extraction, power plants, higher education, and sports facilities.”

PSMJ’s NPMI expresses the difference between the percentage of firms reporting an increase in proposal activity and those reporting a decrease. PSMJ Senior Consultant and QMF Survey Manager Greg Hart notes that only four of 58 submarkets (office for lease, retail for lease, restaurants and petroleum facilities) recorded a negative NPMI in the second quarter (meaning that more respondents saw fewer proposal opportunities than they did in the first quarter. By contrast, only 16 submarkets reported a positive NPMI in the second quarter of 2020.

Other financial indicators tracked by the survey underscore the health of the market for A/E/C services. The NPMI for second quarter revenue results increased from -5 percent in the fourth quarter of 2020, to 17 percent in the first quarter and 49 percent in the last quarter. The percentage of firms that expect revenue growth in the third quarter over the second quarter was 73 percent compared with only three percent anticipating a decline, for an NPMI of 70 percent. Backlog, which had a zero percent NPMI in the fourth quarter of 2020, increased from 26 percent in the first quarter to 42 percent.

Housing Leads All Markets

The housing market topped all 12 major markets for the third time in the last four quarters with an NPMI of 68 percent. All five housing submarkets had strong showings in the second quarter, including condominiums. After lagging other housing submarkets for the past few years, condos reported an NPMI of 59 percent, up from 30 percent in the prior quarter and 15 percent in the fourth quarter of 2020.

“To look even further into the future, we carefully track the housing subdivision market which, directly or indirectly, strongly influences about 80 percent of A/E industry revenues,” adds Burstein. “This market continues to be red hot, so we see no slowdown in activity for the foreseeable future. And if the federal government passes a significant infrastructure bill, those sectors will become even hotter.”

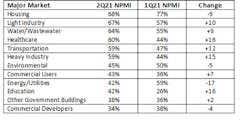

Light industry, paced by warehousing/distribution and component assembly facilities, was the second- hottest major market in the second quarter, with an NPMI of 67 percent. It was followed by water/wastewater (64 percent) and healthcare (60 percent). Healthcare and education had the greatest gains over the prior quarter, each up 16 NPMI percentage points, with heavy industry (+15) and transportation (+12) also strong gainers.

PSMJ’s Quarterly Market Forecast – Major Markets 2nd Quarter of 2021

Product manufacturing (73 percent NPMI) led all submarkets, just ahead of multifamily residential (71 percent) and single-family subdivisions (68 percent). See the chart below for a full breakdown of submarket performance.

PSMJ has been using the QMF as a measure of the design and construction industry’s health every quarter for the past 18 years, assessing the results overall and across 12 major markets and 58 submarkets. The company chose proposal activity because it represents one of the earliest stages of the project lifecycle. A consistent group of over 300 firm leaders participate in the survey.

PSMJ'S Quarterly Market Forecast - Submarkets Second Quarter 2021

About PSMJ: For more than 40 years, PSMJ Resources, Inc. has been recognized as the leading publishing, executive education, and advisory group devoted completely to improving the business performance of A/E/C organizations worldwide. For more information, CLICK HERE.