Copper Report: 2008 Still Reverberates in U.S. Economy

Although it has now been 13 years since the Great Recession, the ramifications are still reverberating throughout the economy, while the pandemic has further impacted global supply chains, and upended historic key economic relationships.

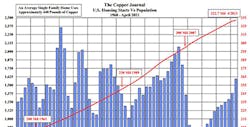

To help put the disaster into perspective, we have to look no further than the charts linked below, illustrating building and real estate activity, two critically important sectors of our economy. We say this because it is our firm belief that home building and home ownership are the most important and encompassing indicators of economic growth, and the personal wellbeing of society.

The first chart shows housing starts reaching a multiyear high of 2.07 million in 2005, coinciding with our expanding economy, and rising population. From that peak, the economy initially began to slow as interest rates were rising, but the retreat turned into a rout as starts ultimately tumbled to a low of just 554,000 homes by 2009, down 1.5 million, or 73% from the high. The severity of the freefall nearly defies comprehension.

Home building and home ownership are the most important and encompassing indicators of economic growth, and the personal wellbeing of society.

Since then, it’s been a long and arduous climb back up, despite massive governmental intervention and record low interest rates for a protracted period of time. While the annual chart shows measured but steady improvements, the monthly graphs are indicating a recent slowing of activity, and also illustrate a distortion of statistics from the impact of the pandemic as it took hold last year.

That is to say, housing starts rose 67% in April from last year when economic activity ground to a halt. Likewise, building permits rose 61% from the year ago period; new home sales climbed 48%, while sales of existing homes rose 34% - all from an extremely low base due to the pandemic. This is similar to the Fed’s view of rising prices now, relative to the lows of last year.

While the economy overall is doing better as things gradually return to normal, the housing market may be easing due to rapidly rising prices, along with a shortage of materials and workers that are also showing up in the broader economy, and raising concerns of rising inflation.

Nevertheless, as you can see, more recent statistics are easing in each of the categories, as starts fell nearly 10% in April from March, while permits rose just 0.3%, but are off 7% from January.

Sales of new homes fell almost 6% in April, and are off 13% from the recent high in January, while existing home sales declined 3% in April, and are down 12% from January. Conversely, inventories of existing homes available for sale, while still extremely low, have risen during each of the past three months.

So, while the economy overall is doing better as things gradually return to normal, the housing market may be easing due to rapidly rising prices, along with a shortage of materials and workers that are also showing up in the broader economy, and raising concerns of rising inflation.

We know that metal markets have been on a tear for over a year now, but here too, just as in many industries, after hitting record high prices in 2011, markets went into a five year downtrend, thereby delaying or cancelling investments that we now sorely need.

But if there’s a curiosity here, it is that although consumer price statistics last week told us inflation has risen to a 13-year high, gold and interest rates tell us there’s nothing to worry about. Yet?

About the Author

John E. Gross

President

John Gross is President of J.E. Gross & Co. a metals management and consultancy firm he established in 1987, to assist companies in their procurement of metals, scrap recycling, and price risk management.

In addition to his consulting activities, Mr. Gross has worked with global leaders in the metals industry over the past 45 years.