Construction Rollercoaster: Spending and Employment Numbers Go Up, Then Down

WASHINGTON, April 3—National nonresidential construction spending increased 0.4% in February, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $982.2 billion for the month.

“Nonresidential construction spending increased for the eighth time in the past nine months in February,” said ABC Chief Economist Anirban Basu. “Importantly, almost all of the nonresidential sector’s momentum is attributable to manufacturing-related construction, which accounted for nearly 35% of the year-over-year growth in spending. Excluding the manufacturing segment, spending in the other 15 nonresidential segments collectively declined in February.

“While the manufacturing segment should continue to see elevated levels of investment, tightening credit conditions will likely hinder nonresidential construction momentum in the near term,” said Basu. “Contractors maintain a healthy level of backlog, according to ABC’s Construction Backlog Indicator, but a gloomy economic outlook and difficulty securing financing are potential headwinds for the industry for the rest of 2023.”

In related news, ABC reported on April 4 that the construction industry supported 412,000 job openings in February, according to an ABC analysis of data from the U.S. Bureau of Labor Statistics’ Job Openings and Labor Turnover Survey. JOLTS defines a job opening as any unfilled position for which an employer is actively recruiting. Industry job openings increased by 129,000 last month, but are down 9,000 from the same time last year.

“This also reinforces the findings from ABC's latest Construction Confidence Index, which indicate that the typical nonresidential construction firm remains in growth mode, expecting sales, employment and even profit margins to expand over the next six months,” said Basu. “In the face of numerous headwinds, the resilience of the U.S. nonresidential construction industry remains remarkable.”

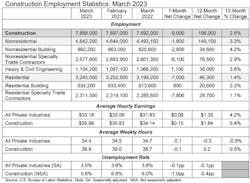

Then came news from ABC on April 7, that the construction industry lost 9,000 jobs on net in March, according to its analysis of data released on April 7 by the U.S. Bureau of Labor Statistics. On a year-over-year basis, industry employment has grown by 196,000 jobs, an increase of 2.5%.

The construction unemployment rate declined to 5.6% in March. Unemployment across all industries decreased from 3.6% in February to 3.5% last month.

“The March employment report may hint at growing economic weakness in the months to come,” said ABC Chief Economist Anirban Basu. “While the nonresidential construction industry lost fewer than 2,000 jobs, the addition of jobs in publicly financed construction categories masks more substantial weakness in private segments. It is precisely those private segments that tend to be most affected by slowing economic growth, deteriorating confidence and concerns regarding the nation’s banking system.

“While the nation continues to progress economically, headwinds are building,” said Basu. “Recession remains a likely outcome within the next 12 months. Contractors generally report healthy backlog and confidence regarding the next six months, but the industry may be positioned for meaningfully weaker conditions in 2024.”