Every few years, this report series returns to the two big issues in improving profitability - gross margin and payroll. This redundancy is required because these two factors are the most difficult to bring into line and the easiest to fall out of line.

The pressures associated with a sluggish economy give these two factors even more relevance. When things are slow, price pressures are inevitable. At the same time, sluggish or declining sales volume almost always results in an increase in payroll expense as a percent of sales.

This report will examine two issues associated with getting control of both gross margin and payroll.

-

Measuring Performance - A review of how to best measure gross margin and payroll performance in a changing environment.

-

Measuring Performance

Setting Gross Margin and Payroll Goals - The development of specific targets for improvement to return performance to desired levels.

When things are in a state of flux, such as a recession, individual performance measures often become temporarily distorted. Gross margin as a percent of sales might fall to extremely low levels. In addition, it is usually not possible to reduce payroll as fast as sales fall, so payroll percentages rise sharply.

While no ratio is perfect under such conditions, probably the most beneficial for measuring margin and payroll control in aggregate is the Personnel Productivity Ratio (PPR). The PPR is payroll (including all fringe benefits) expressed as a percentage of gross margin dollars.

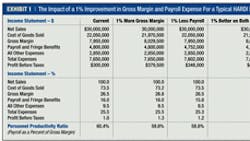

Exhibit 1 provides a financial overview of a typical HARDI member firm based upon the 2010 PROFIT Report (survey opens for 2011 reporting this month). The first column in the exhibit provides current results in both dollars and as a percent of sales. We also provide the PPR calculation.

This firm generates $30 million in revenue and earns a pre-tax profit of $300,000, or 1.0% of sales. The keys to generating this level of results are a gross margin of 26.5% of sales and payroll expense of 16.0% of sales.

These figures result in a PPR of 60.4% (payroll expenses of $4,800,000 ÷ gross margin of $7,950,000). This means that for every $1.00 of gross margin that is generated, 60.4¢ must go to payroll. This leaves 39.6¢ to cover all other expenses and to generate a profit.

Almost all of the PPR guidelines bandied about are pure mythology. It is impossible to set an absolute goal without understanding the economics of the specific line of trade. The best way to set a goal is to examine the performance of the high-profit firm as reported in the HARDI PROFIT Report.

Based upon this data set, a realistic PPR goal is approximately 52.6%. This means that the typical firm should look for a reduction in the range of 7.8 percentage points over time. The challenging issues, of course, are

Setting Gross Margin and Payroll Goals

- how quickly can you improve results and,

- how to make the improvement.

Unfortunately, reducing the PPR by 7.8 percentage points is not an actionable objective. It is too difficult to understand exactly how to make improvements. So it is necessary to break the PPR into its two components - gross margin and payroll expense - and set individual goals for each.

Setting goals for these items is a company-specific undertaking. However, every firm should set goals that it can view as “bite-sized chunks,” which can be readily achieved. A realistic starting point is to improve these factors by about 1.0%. Exhibit 1 reflects such a small, but meaningful, undertaking. For ease of understanding, the exhibit demonstrates the impact absent any sales increase for the firm - all the changes related to gross margin and payroll.

Specifically, in the second column, the firm generates 1.0% more margin dollars on the same sales. In the third column, the firm reduces its overall payroll burden by 1.0%, again with the same sales. The final column demonstrates the impact of making both changes at the same time.

Both actions cause the PPR to fall to 59.8%. However, since gross margin is a larger number than payroll, the improvement in margin has a larger impact on net profit before taxes than the improvement in payroll. Both are key drivers of performance, though.

Page 2 of 2

Ideally, the firm can make both margin and payroll improvements at the same time. In the last column, the PPR falls to 59.2%. This is twice the impact of making each of the changes separately.

The intent of the exercise is to set some goals that everybody in the firm feels can be met, even during a period of economic challenges. The reality, though, is that goals are simply abstract ideas until a specific action plan for their achievement is put in place.

Gross Margin - In the current economic environment, substantial price increases are a pipe dream. However, firms continue to under-price their slowest selling items and special order merchandise. The improvement potential is more substantial than most firms believe.

Slow economic times also create an opportunity to deal with problems that everyone ignores when they are too busy. Pricing errors are endemic to firms with lots of SKUs. Cleaning them up creates “free” gross margin dollars. Tighter control of shrinkage also represents a significant opportunity.

Moving Forward

Payroll Expense - Most firms believe that productivity improvements (better scheduling, automated warehousing, etc.) will solve the payroll challenge. Historically, productivity improvements have driven higher levels of sales per employee but have done nothing to lower payroll costs as a percent of sales or to lower the PPR. Wages, health-care premiums and the cost of other benefits have risen right along with sales per employee.

The key to payroll control is two-fold. First, more attention must be given to order economics. The number of lines per order and the average line value must be increased. This is not a productivity improvement: It actually results in doing less work. Second, the service profile of the firm needs examination. Most firms provide a lot of wonderful services and a few that nobody cares about. It is time to drop services that don't enhance profitability.

The never-ending economic challenges being experienced at present have taken as much of a psychological toll on employees as they have on profits. When the staff is tired and the future uncertain, improvement plans lose credibility.

This is a great time to set small improvement targets combined with strong implementation plans. The 1.0% goals identified here are one such opportunity. Over time, small improvements in the key drivers of profitability will generate significant improvements in the bottom line.

Dr. Albert D. Bates is founder and president of Profit Planning Group, a distribution research firm headquartered in Boulder, CO.

©2010 Profit Planning Group. HARDI has unlimited duplication rights for this manuscript. Further, members may duplicate this report for their internal use in any way desired. Duplication by any other organization in any manner is strictly prohibited.