HVAC IN THE USA: HVACR + Water Heating Manufacturing Hit $211 billion in 2021

Arlington, Va. Jan. 2, 2024 – The Air-Conditioning, Heating, and Refrigeration Institute (AHRI) today released the results of a 2021 economic analysis conducted on its behalf by the research firm Inforum. Using detailed census data, researchers concluded that HVACR and water heater manufacturers made significant contributions to the nationwide economy, directly and indirectly supporting 704,400 U.S. jobs, with a total economic output of $211.3 billion.

These figures demonstrate that, despite the economic challenges of the Covid-19 pandemic, the industry maintained its status as a strong job creator. Direct employment increased by more than 10,000 jobs between 2017 and 2021, growing from 125,900 to 137,300, reversing a trend that began during the Great Recession of 2008-2009. This number excludes jobs created by other segments of the supply chain such as materials, energy, or shipping.

The report found that manufacturers are, “especially important to states where activity is concentrated.” Texas accounted for the most direct and total output, generating $6.2 billion and $17.8 billion respectively. Other states with sizable output included Missouri, Georgia, and Ohio. California mainly benefited from total output, with the industry generating $8.3 billion in the state through manufacturing jobs, supplier jobs, and spending from industry wages.

This report presents an economic analysis of the domestic heating, ventilation, air-conditioning, commercial refrigeration (HVACR) equipment and water heater

manufacturing industry. The study provides information on recent trends within the

industry, along with its contributions to the U.S. economy in 2021.

The scope was defined using relevant shares of economic data to analyze manufacturing activity of:

• Fans and Air Purification Equipment

• Heating Equipment

• AC and Refrigeration Equipment

• Water Heaters.

Pre- and Post-Pandemic

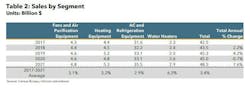

The report authors describe how sales of HVACR equipment and water heaters grew moderately in 2018 and 2019. A mild contraction in 2020 highlighted the resilience of the industry during a period of pandemic-related turmoil and uncertainty. Sales rebounded in 2021 as normal conditions resumed. As defined in this study, sales grew by an average annual rate of 3.4% between 2017 and 2021.

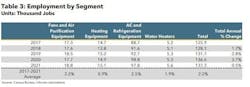

Following an extended period of job reductions, the industry began adding jobs following the Great Recession of 2008-2009. This trend continued in recent years, with employment increasing by more than ten thousand between 2017 and 2021; total jobs in the industry increased from 125.9 thousand to 137.3 thousand over this span.

With a large and growing economy, Texas ranked first for both direct ($6.2 billion) and total ($17.8 billion) output; roughly one-eighth of direct output is found in the Lone Star State.

This report measures three types of economic activity associated with HVACR

equipment and water heater manufacturers:

1. Direct Impacts - Activity generated within the focus industry. In this case, the manufacturing of HVACR equipment and water heaters serves as the direct impact.

2. Indirect Impacts - Activity generated in other industries due to purchases (materials, energy, and services) by the focus industry through their supply chains.

An Economic Analysis of the U.S. HVACR Equipment and Water Heater Manufacturing Industry

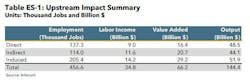

3. Induced Impacts - Activity generated by spending linked to income earned from direct and indirect production. The impacts of manufacturers and upstream suppliers are displayed below in Table ES1. When indirect and induced impacts are included, the industry supported 456.6

thousand jobs and generated $144.4 billion in economic output in 2021.

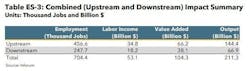

In addition to these upstream impacts, economic activity is generated in wholesale and retail trade (“downstream”) industries that distribute HVACR equipment and water heaters. In this case, the margins earned by wholesalers and retailers serve as the direct impact. A summary of downstream impacts is displayed in Table ES-2. In total, downstream activity supported 247.7 thousand jobs and $66.9 billion in economic output

The combined impacts are seen in Table ES-3, with total upstream and downstream

employment amounting to 704.4 thousand jobs and $211.3 billion in economic output

The national-level economic impacts can be seen as the sum of economic impacts at the state level. National-level direct production, employment, value added, and earnings have been distributed to the state level using employment shares taken from the BLS Census of Employment and Wages (CEW). Indirect and induced impacts at the state level are estimated using Bureau of Economic Analysis’ Regional Input-Output Modeling System (RIMS) data.

Like many industries, HVACR equipment and water heater manufacturers are concentrated in particular regions. This is often due to proximity to suppliers and the availability of skilled workers. Table ES-4 highlights the top 10 states as measured by direct output and total output. With a large and growing economy, Texas ranked first for both direct ($6.2 billion) and total ($17.8 billion) output; roughly one-eighth of direct output is found in the Lone Star State. Tennessee ranked second in terms of direct output, but third when indirect and induced output are factored in. California, meanwhile, does not rank in the top ten for direct output but ranks second when indirect and induced impacts are factored in. Other states with sizable output include Missouri, Georgia, and Ohio

INDUSTRY SALES

The overall industry recorded moderate growth in both 2018 and 2019, before contracting 0.7% in 2020. This mild dip demonstrated resilience during a period of significant uncertainty during the COVID-19 pandemic. On the supply side, many businesses experienced restrictions on operations. Demand, meanwhile, was relatively strong despite substantial job losses; those with disposable income

increasingly opted to invest in their homes. Sales rebounded with 7.6% growth in 2021 as normal conditions began to return.

All four industry segments reported positive average annual sales growth between 2017 and 2021.

Of the four segments analyzed, ‘AC and Refrigeration Equipment’ account for the vast majority of activity in 2021, comprising 73.2% of total sales. This was followed by ‘Heating Equipment’ (10.9%), ‘Fans and Air Purification Equipment’ (9.9%), and ‘Water Heaters’ (6.0%).

Looking at broader trends, all four industry segments reported positive average annual sales growth between 2017 and 2021. As seen in the final row of Table 2, the most rapid increase was observed in the ‘Water Heaters’ segment (+6.3%). Growing second swiftest was ‘Heating Equipment’ (+5.2%), followed by ‘Fans and Air Purification Equipment’ (+3.1%), and ‘AC and Refrigeration Equipment’ (+2.9%).

EMPLOYMENT

According to current estimates, total jobs increased by more than ten thousand between 2017 and 2021, increasing from 125.9 thousand to 137.3 thousand. Recent growth reflects a continuation of trends dating back to 2010 when the industry was still recovering from the Great Recession. Total employment growth accelerated for three consecutive years, including 3.7% growth in 2020, before moderating in 2021.

According to current estimates, total jobs increased by more than ten thousand between 2017 and 2021, increasing from 125.9 thousand to 137.3 thousand.

While each industry segment recorded gains between 2017 and 2021, the bulk of the growth (+9.1 thousand jobs) was observed in the ‘AC and Refrigeration Equipment’ category. Additionally, this component recorded the quickest average growth over the period (+2.5%)

HVACR equipment and water heater manufacturing directly accounted for 137.3 thousand jobs and $48.5 billion in output in 2021. This economic contribution does not exist in isolation, however. Manufacturers support upstream industries through the purchases of goods, services, and energy. These indirect impacts generate an additional 114.0 thousand jobs and $44.1 billion in output. Finally, induced impacts (spending of earnings by direct and indirect employees) contributed a further 205.4

thousand jobs and $51.9 billion in output. Together, this totals 456.6 thousand jobs and $144.4 billion in output.

The downstream analysis focuses on the economic activity associated with the distribution of HVACR equipment and water heaters through wholesale and retail outlets. This portion of the study uses the margin or markup earned on sales as the direct impact. It was estimated to be $23.6 billion in 2021, which supported 84,100 direct jobs. The downstream activity has its own indirect and induced impacts. When these are included, total downstream activity approaches $67 billion in output and 248

thousand jobs. Combining the upstream and downstream impacts results in a total output impact of

$211.3 billion and 704.4 thousand jobs.