2013 HVAC Service Vehicle Survey: Making Tracks

Once upon a time, you could roughly gauge the revenue of an HVAC company based on the number of service vehicles used in their daily operations. Today, with fuel prices high, insurance rates higher, and the cost of doing business climbing, that “rule of thumb” doesn’t necessarily apply anymore.

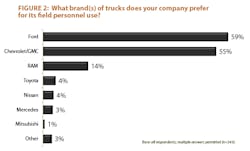

Brand Preference

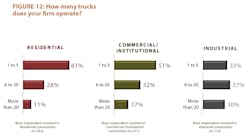

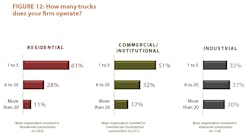

The market sectors did show some difference with regard to the size of the fleets the respondents maintain. For example, contractors working in the industrial sector report the largest fleets (an average of 12 trucks) followed by those involved in the commercial/institutional sector (nine trucks), and residential (eight trucks).

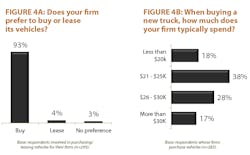

Buy Vs. Lease

Figure 4 shows that virtually all the respondents report that their companies prefer to purchase their vehicles (93%) rather than lease them. When purchasing a new truck, the typical respondent pays an average of $23,600.

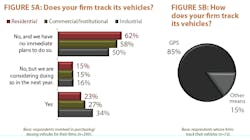

In this age of Internet monitoring and high-tech vehicle tracking, it’s surprising to find that relatively few of the respondent firms track their vehicles, and even fewer have plans to start doing so within the next year. Figure 5 shows that those in the industrial sector are most likely to track their vehicles (34%).

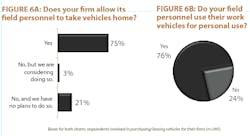

Another interesting fact is shown in Figure 6: the vast majority of contractors allow their field personnel to take vehicles home (75%). Another 3% are considering this option.

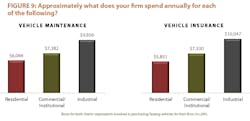

Surprisingly, 76% of the respondents also allow their field personnel to use their work vehicles for private use. This is surprising because of the high per-vehicle insurance costs contractors are paying (Figure 9).

Vehicle Maintenance

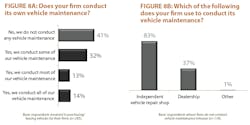

We wanted to know how contractors choose to maintain their vehicles. Figure 8 details their responses.

Just over half of the respondents (59%) report they do at least some of their own vehicle maintenance, including 14% who conduct all vehicle maintenance in-house. Companies that outsource vehicle maintenance are most likely to use an independent vehicle repair shop for this service (83%).

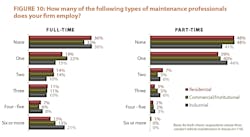

The number of full-time maintenance professionals employed varies somewhat by market sector. For example, the average number in the residential sector is three professionals. In the commercial/institutional sector the average is five professionals and in the industrial sector it’s eight.

Respondents whose firms conduct their own vehicle maintenance employ an average of one part-time maintenance professional.

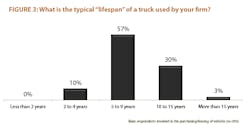

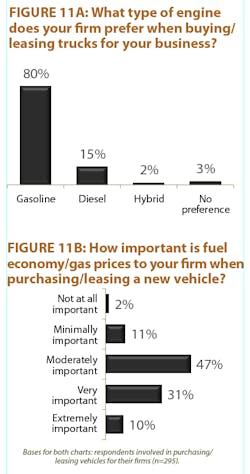

It’s interesting that fuel efficiency doesn’t seem to be all that important (see Figure 11), which is a fairly significant change from other surveys done over the last five years. The focus is on keeping trucks running longer.

So, whether you see vehicles as rolling billboards or tools of the trade, costs and maintenance are more important than ever.

Safe travels, everyone.