HVAC Industry Forecast: Looking for a 'Build-Up'

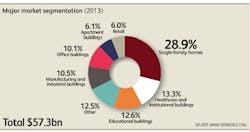

The HVAC industry is heavily influenced by activity in the construction market, with the majority of industry income generated from HVAC installations in new residential and nonresidential structures. Maintaining, monitoring and repairing existing equipment — the mighty service sector — also accounts for a significant share of revenue, lending the industry some stability in the face of the volatile new construction markets of recent years.

These service segments also make the industry susceptible to changes in levels of disposable income. In the five years from 2008 to 2013, industry revenue is expected to fall at an annualized rate of 1.4%, to $60.9 billion.

The total collapse of the housing market and subsequent economic recession caused new construction activity to decrease dramatically. During much of the five years to 2013 demand for new housing was hampered by an oversupply of existing homes, a growing number of home mortgage foreclosures, and declining property values.

Nonresidential building construction activity also declined, as the recession caused a contraction in the business sector. As unemployment rose and businesses reduced operations, more vacancies in commercial buildings appeared and demand for new nonresidential structures weakened. These factors worked to diminish demand for new HVAC system installations across all construction markets.

Turning a Corner

After three years of declining revenue from 2008 to 2010, the industry turned a corner in 2011, and posted growth of 6% in 2013. Positive signs in the housing market, particularly in the first quarter of 2013, indicate the construction sector’s burgeoning return to strength. As more homes and commercial structures are built, and require HVAC system installations in turn, demand for industry technicians will grow strongly.

National standards for energy efficiency and a growing trend toward lowering household and business energy use is projected to encourage building owners to upgrade to more efficient systems. With these positive trends occurring, industry revenue is forecast to rise at an annualized rate of 3.6% during the next five years, to $72.6 billion in 2018. Growth for 2013 was forecast to come in at a solid 3.8%.

Industry Issues: Threats & Opportunities

Energy-efficient HVAC units are often more expensive than their less efficient counterparts. As a result, the government has created financial incentives through tax credit programs, in order to encourage HVAC system upgrades.

These tax credits were initially set to expire in December 2011, however, the federal government extended the program until December 31, 2013. If the federal government doesn’t renew the program, this would cause decreased demand for energy efficient HVAC units in 2014, precisely when the housing market is rebounding, posing a potential threat to the industry. (Ed. note: the program for forced air HVAC systems has not been renewed for 2014. Geothermal installations will continue to receive a tax credit for 30% of total installation costs until Dec. 31, 2016.)

On the plus side, HVAC contractors derive a substantial share of their revenues from installing HVAC equipment and ducting in new residential buildings and structures, which include single-family homes and multi-family residences, that is, apartment buildings. Although the historic decline in the housing market during the recession and its slow recovery damaged the industry over the past five years, housing starts are expected to increase in 2014, presenting a potential opportunity for the industry.

Source: IBISWorld, report on the Residential and Commercial HVAC Industries. For the full report, contact IBISWorld at 800/330-3772. ibisworld.com

HVAC Contractors Reflect on 2013, Look forward to New Year

Bartlett Heating and Air Conditioning, Marietta, GA, grew revenues by 15% in 2013. Vice president Shannon Bartlett says homeowners are deciding to stay in their existing homes rather than try to sell in a buyer’s market, and have moved forward with previously delayed HVAC purchases.

“They have a new way of looking at their homes, and that’s good for us, when they’re willing to invest more in comfort and improved efficiency,” she says.

Bartlett adds that while some competitors are diversifying into plumbing and electrical, Bartlett is staying focused on HVAC , and on customers.

“Every year, we try to refocus on maintaining relationships with customers, not just being the people they call when they need somebody. They’ll call us for referrals to roofing companies or other trades. They’re calling us because they trust us in general. It’s all about good, old-fashioned customer service,” she says. “We don’t use voice mail; so when people call, they speak to a person.”

The company is also redrawing some of the territory covered by its 13 NATE-certified technicians, to improve their concentration near the office, for better response time and reduced drive time.

Hobaica Services — the ContractingBusiness.com 2011 Residential Contractor of the Year — is always an HVAC innovator. It enjoyed about 6% growth in revenue in 2013, and was able to get more to the bottom line, for a more profitable year. President Louis Hobaica rattled off a list of ventures he and his brother Mike and Paul will pursue in 2014 — including new vehicles with a new look, more money for marketing residential service and replacements, adding plumbing, and increased focus on home performance assessments.

“In the past 30 days, we scheduled more than 80 home performance inspections. In the past, we were lucky to schedule 10 per month,” Hobaica says. “Light commercial service and replacement is coming back, and we expect wine cellar sales to increase in 2014.”

Tri-City Refrigeration, in Wisconsin Rapids, WI provides HVAC for homes and businesses. For 2014, President Andrea Jensen plans to sharpen the company’s focus on Indoor Air Quality (IAQ) and energy efficiency.

“We’ll use AirAdvice for our IAQ work, and home performance services will include blower door testing and other measurement methods. We have an energy efficiency sales technician who has been trained in home and building efficiency,” she says. Andrea and her brother, Scott Virnig, run the business purchased by their father, Denis Virnig, in 1974. Scott manages field personnel and provides technical assistance to technicians and installers.

Tri-City has also reaped the benefits of being a Nexstar member. “Nexstar’s resources are phenomenal,” Jensen says. “If I have a question, any of their staff are happy to help, and I’ve gotten ideas from other member companies on how to expand the business.”

“It was warm in summer and cold in the fall, and that’s good, since we’re dependent on the weather,” says Glen Cliett, president, Cliett Refrigeration, Hillsboro, TX. “We’re always customer driven as well. That’s all we can do. If we’re not providing benefits to customers, we have no value.”

Cliett Refrigeration has added Fireline dispatching, which is compatible with the firm’s Quickbooks accounting software. — Terry McIver