The Boston Consulting Group (BCG) Matrix is a strategic planning tool developed to help companies allocate resources for maximum return among different business units. It can be applied to residential service and replacement contracting to allocate marketing resources among neighborhoods.

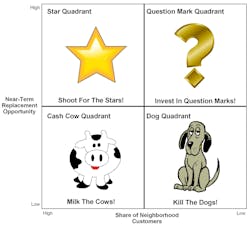

The Contracting Neighborhood Matrix

The matrix consists of two axes. The vertical axis is Near-Term Replacement Potential. This is the amount of systems that can be expected to be replaced in a definable neighborhood or other geography over the coming few years. The range is very low to very high potential.

A 12-year-old tract neighborhood is an example of one with a very high Near-Term Replacement Potential. With a median replacement age of 15 years and a spread of +/- three years, systems can be expected to be replaced starting in year 12 and continue through year 18. The prime replacement year is the 15th. For each subsequent replacement cycle (i.e., 30 years, 45 years, etc.), the spread with increase and the intensity of replacements for the prime replacement year will lessen somewhat.

Replacement cycles for custom home neighborhoods built over a decade or two and neighborhoods built before air conditioning was a standard part of new home construction are difficult to identify. Ultimately, the potential for these must be determined by company experience and contractor intuition.

The horizontal axis is the contractor’s Share of Neighborhood Customers. Like the Near-Term Replacement Potential the range is very low to very high. Using mapping software and customer databases, it is possible to identify the exact percentage of homes in a given neighborhood a contractor has served. Where a contractor sets the limits, depends on the company. For some contractors, 10% of the homes in a neighborhood will represent a relatively high share. For others, it is relatively low.

The Four Quadrants

The matrix can be broken up into four quadrants. In keeping with the BCG Matrix, the vertical axis (bottom to top) ranges from low to high. The horizontal axis (left to right) ranges from high to low.

The Star Quadrant - In the upper left quadrant is relatively high Near-Term Replacement Potential and relatively high Share of Neighborhood Customers. This is the Star Quadrant. Neighborhoods that can be classified as Stars are extremely lucrative. A contractor’s relatively high market share in the neighborhood means the contractor will benefit from word-of-mouth and top-of-mind-awareness, yet should nevertheless market heavily to the neighborhood due to the lucrative nature of upcoming replacements. Shoot for the Stars!

The Cash Cow Quadrant – In the lower left quadrant is relatively low Near-Term Replacement Potential combined with relatively high Share of Neighborhood Customers. This is the Cash Cow Quadrant. Neighborhoods classified as Cash Cows should be harvested. With word-of-mouth and top-of-mind-awareness already high, little additional marketing is needed from these neighborhoods that will generate high margin service work until the next replacement cycle. Market to existing customers and make sure customer service levels are high to keep up the word-of-mouth, but do not invest in customer acquisition. Milk the Cash Cows!

The Question Mark Quadrant – In the upper right quadrant is relatively high Near-Term Replacement Potential combined with relatively low Share of Neighborhood Customers. This is the Question Mark Quadrant. Neighborhoods classified as Question Marks require investment. The replacement potential is there, but the contractor lacks presence. Thus, marketing is needed with the goal to gain sufficient customers in a short enough period of time to shift the neighborhoods to the Star Quadrant. Invest in Question Marks!

The Dog Quadrant – In the lower right quadrant is relatively low Near-Term Replacement Potential combined with relatively low Share of Neighborhood Customers. This is the Dog Quadrant. There is little presence and not enough potential to justify investment. Take calls from neighborhoods in the Dog Quadrant, but don’t invest. Kill the Dogs!

Benefits of Neighborhood Portfolio Strategy

Contractors have limited resources. By targeting marketing dollars where the near-term returns are highest, contractors can maximize the impact of those limited resources. The result is greater marketing effectiveness leading to stronger bottom lines.

Portfolio strategy does not need to be applied to neighborhoods. It could be applied to zip codes, entire suburbs, or rural communities. Any geography that makes sense will work. It is also possible to apply a high-level view of portfolio strategy at say, the suburban level, and then apply it at the neighborhood level only within the Question Mark and Star suburbs.

For the tools you need to maximize your sales and marketing, visit the Service Roundtable at www.ServiceRoundtable.com or call 877.262.3341 and ask to speak with a Success Consultant. Service Nation offers multiple membership programs, starting with the Service Roundtable at $50 per month through the intense Service Nation Alliance for contractors who are serious about success.

About the Author

Matt Michel

Chief Executive Officer

Matt Michel was a co-founder and CEO of the Service Roundtable (ServiceRoundtable.com). The Service Roundtable is an organization founded to help contractors improve their sales, marketing, operations, and profitability. The Service Nation Alliance is a part of this overall organization. Matt was inducted into the Contracting Business HVAC Hall of Fame in 2015. He is now an author and rancher.