Is HVACR Industry Health Care Confusion the Rule?

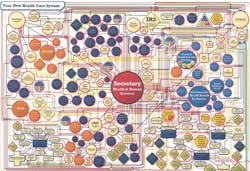

The Patient Protection and Affordable Care Act (PPACA), Health Care and Education Reconciliation Act are attempts by our federal government to do something good. Make no mistake, the intent is to help every American, no matter their age, race, employment status, party affiliation, etc., to be covered by health care insurance. But like most things that start out as a good idea, the PPACA is fast becoming a business nightmare.

Last month, while attending the International Roundtable meeting in Dallas TX, Melanie Gentry, of Comprehensive Employment Solution in Healdsburg, CA, told HVAC and plumbing contractor attendees that the PPACA is complicated, confusing, and the rules are subject to change at any time.

As it stands right now, the basic rules are as follows. Effective January 1, 2014, if your company employs 50 or more people:

- You must provide all full-time employees with approved health care coverage.

- If you don’t provide a government-approved health plan, you face a $2,000 per employee penalty/fine/tax.

If your company has less than 25 employees and they have an average income of $50,000 or less, you’ll need to pay 50% of their health care coverage to receive tax credits through the end of 2015.

- In 2014, small businesses can purchase insurance from an “exchange.” Companies with more than 25 but less than 50 employees are not required to provide health care, but receive no tax credits.

- For more info, go to bit.ly/HCare_Credit.

The individual mandates for your employees are as follows:

- Individuals who don’t obtain or retain qualifying health care coverage will be required to pay a penalty as part of their income tax returns.

- In 2014, the penalty is $95 or 1% of the individual’s income, whichever is greater.

- By 2016, it can increase to $695 or 2.5% of income, whichever is greater.

- For families, the maximum penalty is three times the per-person flat-dollar penalty.

Any person not covered under a qualifying health plan will be assessed a penalty/fine/tax starting in 2014 at $95, and that can increase up to $2,800 by 2016.

With the PPACA mandating that every person must buy health insurance or pay a penalty/fine/tax, every employee and potential employee will want to know how you’re looking out for them. In other words, keeping quality personnel may come down to the health care solution you provide that doesn’t empty their wallets.

Buying Health Care Insurance Via An “Exchange”

What is an exchange? Well that depends on which insurance company’s propaganda you read. In essence, Gentry says, federal or state government acts as the buyer of health insurance through approved insurance providers. There is one negotiation for prices and benefits for various tiers of coverage. Only plans that are approved will be available for purchase by individuals or companies.

Now here’s the confusing part: she says that “exchanges (federal or state) will be powered or enforced by an individual mandate and states have a choice whether or not to create an exchange. If the state doesn’t opt to create an exchange, that state will use the federal exchange.” I really don’t know what this means and according to Gentry these definitions change every day.

So that’s how you provide health care coverage. Did you know you then have to prove it? Our friends at the IRS are who you must prove it to and they haven’t yet announced guidelines. According to Gentry, the IRS indicated it will likely follow the procedures used now to report investment income to the government. Health care coverage information becomes mandatory on W-2 forms starting in 2014.

The bottom line: as business people, you need to prepare. These laws are here to stay and there's no use trying to fight it. What you need to do is develop a strategy.

Still, who’d have thought that health care coverage could become another tax?