Dodge Economist Sees a Brighter 2024

One of the industry's most informed and respected forecasters, Richard Branch, chief economist for Dodge Construction Network, here explains why he has such an upbeat outlook for 2024. But how did we manage to avoid that long-predicted recession? What potential roadblocks are still out there? Which markets hold the most promise?

CB: Mr. Branch, before we dive into your 2024 forecast, please tell us a little bit more about yourself and Dodge Construction Network.

Branch: Dodge as a company has been around for well over a 100 years. Essentially, what we do is track construction projects from their earliest germination in planning all the way through to breaking ground, which is what we call a start. So not only are we tracking the physical attributes of those projects -- i.e. where it is, what kind of building it is, how big it is, how expensive it is -- we're tracking who's working on the project, who wants to work on the project, as well as what products are being spec'ed, etc.

So it's a huge sandbox of data that we get to play in. And just to give you a little perspective on that, we're entering several thousand new projects in our database every month. So what I do, as the chief economist here, is essentially our market sizing part of the business. And what we're forecasting is whether these construction verticals -- like office or single-family or roads and bridges -- are going to grow or contract in the year to come.

- To download Dodge's 2004 Outlook eBook, click here.

And actually our forecast goes out over five years and essentially we're serving as a strategic partner for our clients. We're essentially giving them that roadmap of where we think the economy is going to go and where we think the construction sector will go with it. We forecast across 22 different verticals from residential, non-residential building and infrastructure at the national level, all the way down to the 3,000-plus counties in the United States. So it is an expansive set of data that I am fortunate enough to get to play with every day. Dodge Construction Network

CB: As you say, Dodge has been at this for over a century, which means it has seen some truly extraordinary history. Of course, the last few years with the pandemic and both domestic and international political tumult has certainly added to that. What has it been like to try to forecast the world economy in a climate as extraordinary as this?

Branch: It's not been easy, I'll tell you that. But as I think about it, and I think you just used the word 'extraordinary', and that really I think is a great word to use because as we look back over previous economic cycles, whether it's the Great Recession; whether it's the tech bubble burst; whether it's back to the 1980s, the '70s; we have this long data set of history. As I look back on all that, the issues that we're facing now, maybe not the exact issues, but the questions we're asking ourselves and the questions we're asking of the data haven't really changed that much.

We're essentially questioning how these statistical relationships match up. And I'll give you a couple of examples of one from the past, and one from right now. If you go back to the Great Recession, we were questioning how the linkage between retail construction and retail sales broke apart? Because of e-commerce, right? So that statistical model broke and we had to adjust it and change.

We're seeing the same thing now as it relates to remote and hybrid work, changing how we look at the office market. So, as I think about the sector and what causes these downturns, essentially it leads to an evolution in the construction market and, in that way, this current cycle isn't really different. This is just another evolution in the construction sector.

I do think though, what's different about this last couple of years, starting with the pandemic up to now, is that a lot of those risks that we're talking about, especially on the geopolitical side, are harder to predict and harder to quantify, whether it's Israel, Hamas, Ukraine, Russia, China, Taiwan, even political risk here at home. And what I mean by risk here is whether Congress will pass the appropriation bills to fund infrastructure construction in 2024. These current episodes that we're trying to see our way through, if I could talk about my feelings for a little bit here... Those situations just feel much more acute than what we've seen in past cycles.

CB: Okay, let's get into some specifics of what Dodge foresees for 2024. What is Dodge's prediction for construction overall, and which markets do you think will lead the way? Which markets seem most likely to decline?

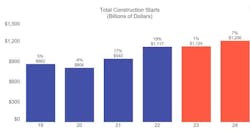

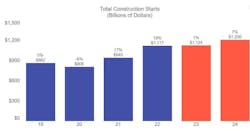

Branch: Well, let's step back for a moment and talk about how the market played out in 2023. If we look back, I would say the sector really bifurcated in a very significant way. On one side of the plate, we had publicly funded construction which did rather well last year. The other side of that was the private side of the market, whether that's in residential or in private buildings, that didn't do well and suffered quite a bit. As we think about how that's going to change in 2024, I don't see that narrative shifting too much. I continue to think that the public side of the market will outgrow the private side and maybe let's go forward from here and break that discussion down.

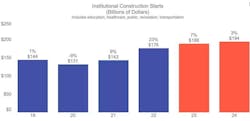

If we look at the public sector, the dollars flowing from the Infrastructure Act are coursing into the system and causing double-digit growth across most of our infrastructure categories, whether it's highways, bridges, water, sewer, etc. So there is really tremendous opportunity in the infrastructure markets. Those public dollars, though, also spread beyond just infrastructure.

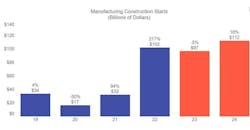

If you look at the CHIPS Act in 2022, and the Inflation Reduction Act in 2023, we saw a record level of manufacturing construction in our data. The 2023 total looks like it's just coming in maybe 4-5% lower than it was in 2022, but those are all public dollars flowing into that market, as well, supporting construction. Public laboratory construction, which is part of our education sector is doing rather well, too. K-12 school construction is doing well and healthcare and other public sector projects also are performing rather nicely.

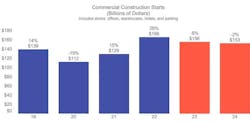

CB: So far, that's all encouraging news. But what about the commercial markets?

Branch: The sticky wicket is more on the private side of the market. But I do think as we look at the data, and you mentioned the Dodge Momentum Index (DMI) before, which tracks nonresidential projects, whether they're public or private, when they first enter those early stages of planning. So those projects would have an architect and a general contractor, but they haven't yet broken ground. When we look at the DMI, it's very strong. It's a very high level and very stable. So that gives us hope that especially on the private side of the market, that we're going to see growth in 2024.

I think that starts with residential. We're looking at small gains, not robust gains, in single family and multifamily in 2024. But that inflection point we think in single family has already happened and that momentum is building. We think multifamily joins the party in 2024, so that's a big change in tonality for construction after two years of decline in the residential sector. So that's a big positive small gain, but a gain and a positive is a positive, and we'll take it.

Looking at traditional income property types, i.e. hotels, retail, warehouse, offices, that's still a little mixed, right? When you look at retail and hotel, we think those markets will be very solid in 2024. Retail construction, feeding off the residential growth and hotels feeding off this continued "revenge travel" and the fact that hotel fundamentals are in really solid shape. I'll throw data centers in there, as well. We track data centers under the office sector as a standalone category. Construction is really solid, but we need to draw the line there and the curtain needs to come down. Because when we look at new office construction and warehouse activity in 2024, we think the market continues to contract next year.

So, certainly, still winners and losers, but I think there's going to be more winners than losers in 2024, and that's very different from 2023, when you total the whole market up. For res, non-res building and infrastructure in 2023, we were looking at 1% growth. But for total construction in 2024, we're looking at 7%. So, a much more positive market we think for the new year.

CB: Certainly good to hear. One remarkable undercurrent of all this is that the long-predicted recession never actually showed up. There was much talk about it for over a year now, if not two years. So have we 'dodged' that bullet?

Branch: Right? Yes, I'm afraid to answer that because as soon as I do, something bad might happen. But you're right, the world press has spent much of the last 12-18 months thinking recession, and we were never in that camp.

If we go back a year, year and a half ago, we were pretty consistent in saying that the U.S. economy would avoid recession in 2023, and that turned out to be the case. Of course, as we look forward here, the chances of recession in 2024 are not zero. When we think about that geopolitical risk that we commented on earlier, for example, if we see energy prices spike up because of an expansion in the war in the Middle East, that could certainly be a recession-inducing event. So the odds are not zero, but I think they are significantly reduced from what we were talking about in 2023. And I think what's part of that reduction in those odds of recession is how we view the Fed and where we think interest rates will go.

If you're Fed Chair Jerome Powell, you're probably thinking, all right, we're in good shape here and we can probably stand pat and hold interest rates where they are for the time being and let the market take inflation lower. So if you believe that, and that's what we believe in our forecast, then the next question is, well, what happens next?

It is built into our forecast that the Fed will start cutting interest rates in maybe June or July of 2024. But we need to be cognizant of the fact that that easing and monetary policy is going to be very slow and methodical. If we want to do some quick math here, the current Fed funds rate is in a range of 5.25 to 5.5%. To totally "normalize" interest rates, in other words bring them down to around 2.5%, the Fed's going to have to cut rates by three percentage points in our forecast.

But we don't see that full normalization happening until early 2026. So we're looking at basically a quarter basis point reduction in the Fed funds rate starting in Q3 of 2024, and then another quarter basis point each quarter after that. They're going to take their sweet time on this to make sure they've truly got that inflation monster beat down.

When you think about the impact on the construction sector, we all know that it is one of the most interest-rate sensitive sectors in the economy. So the fact that we're going to be in this high interest rate environment for the foreseeable future really means that that recovery, particularly in residential and in those income property types, is going to be slow to materialize in 2024.

CB: Regarding the Fed, I remember a remarkable quote that you said in your forecast a year ago. You had said then that you felt like the Fed was so focused on bringing down inflation, that it was "willing to break the back of the U.S. economy," if it had to. I guess we should all be happy it never came to that.

Branch: Yes. I think if there's one thing that really surprised me when I look back on 2023 as a whole, it's that everybody, every forecaster I can think of actually under-forecasted the resilience in the U.S. economy, particularly for GDP and consumer spending. It outperformed pretty much through the course of the year. So you're right. The fact that the U.S. economy withstood aggressive interest rate increases over the last several years and held pat, and continues to grow over that time, is really an amazing testament to the strength of U.S. businesses and U.S. consumers.

CB: So looking ahead, aside from the statistics, Dodge is also gathering industry intelligence throughout the year. What other types of issues are you hearing in the marketplace that will affect how projects actually become reality in the months and years to come?

Branch: Great question. Well, if you were to put 100 contractors, building products manufacturers, distributors, etc., in a room, and ask them, 'What is the biggest risk your business is currently facing?' Over the next year, without a doubt, they're going to say their number one issue is a shortage of skilled labor. That's a huge systemic risk that the sector faces as we go forward. And it's not one that's easily addressable.

So technology I think can play a huge part in that. At our recent Outlook conference in Dallas, we had a great panel on the digitization of building plans and how new technologies, including artificial intelligence (A.I.), can help streamline the pre-construction side of the business. Of course, it's hard to have A.I. on a jobsite, right? I mean, A.I. can't build a wall; it can't do plumbing. But A.I. can help potentially in streamlining the design and specification process.

As a result, those projects could move through quicker to construction, and potentially start more efficiently and cheaper. So that changes the calculus of go. So are we seeing that now? I don't know if I have insight onto that quite frankly, but I do think that with the pressure put on the sector by lack of labor that the there for construction to adopt new technologies. And maybe a final point on that is if you look around the sector, we're seeing a lot of, I'll call them non-construction tech firms, starting to get interested in working in the construction sector. I think that's a huge, huge positive in terms of increasing productivity and therefore profitability over the next few years.