Congressional Budget Office

|

Editor's Note: With each forecasting issue, we offer the Congressional Budget Office's (CBO) assessment and projection for the coming year. Most accept the assumption that the CBO is nonpartisan in its analysis of the U.S. budget and economy. While you may not agree with their assumptions and projections, it is important to recognize how the macro issues of the economy might have an impact on your business. This report by the Congressional Budget Office (CBO) presents an analysis of the proposals contained in the President's budget request for fiscal year 2015. The report, titled An Analysis of the President's 2015 Budget (April 2014), can be found at www.cbo.gov/publication/45230. |

The analysis is based on CBO's economic projections and estimating models (rather than the Administration's) and it incorporates estimates of the effects of the President's tax proposals that were prepared by the staff of the Joint Committee on Taxation (JCT).

In conjunction with analyzing the President's budget, CBO has updated its baseline budget projections, which were previously issued in February 2014. Unlike its estimates of the President's budget, CBO's baseline projections largely reflect the assumption that current tax and spending laws will remain unchanged, and therefore the projections provide a benchmark against which potential legislation can be measured. Under that assumption, CBO estimates that the federal deficit would total $492 billion in 2014 and that the cumulative deficit over the 2015–2024 period would amount to $7.6 trillion.

How Would the President's Proposals Affect Federal Deficits and Debt?

The President's budget request specifies spending and revenue policies for the 2015–2024 period and includes initiatives that would have budgetary effects in fiscal year 2014 as well. CBO and JCT estimate that enactment of the President's proposals would boost deficits from 2014 through 2016, but reduce them (by generally increasing amounts) from 2017 through 2024, relative to projected deficits under CBO's baseline. In particular, the President's policies are estimated to have the following consequences for federal deficits and debt:

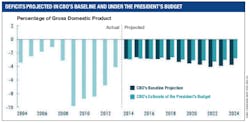

- For 2014 and 2015, the deficit would be about $500 billion, or 3 percent of gross domestic product (GDP). Under the President's policies, deficits would generally increase in subsequent years through 2024 in nominal dollars, growing to between roughly $700 billion and $800 billion at the end of the period.

- Deficits would be smaller than the amounts in CBO's baseline each year from 2017 through 2024. Although baseline deficits trend upward, to about 4 percent of GDP in the latter years of the projection period, under the President's proposals the deficit would remain close to 3 percent of GDP throughout the decade – which is similar similar to the average deficit of 3.1 percent experienced over the past 40 years. By the end of the 10-year period, the deficit under the President's budget would be below the projections in CBO's baseline by nearly 1 percent of GDP.

- In all, deficits would total $6.6 trillion between 2015 and 2024, $1.0 trillion less than the cumulative deficit in CBO's baseline.

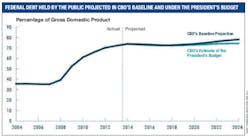

- Federal debt held by the public would increase from $12.8 trillion, or 74 percent of GDP, at the end of 2014 to $19.9 trillion at the end of 2024, still equal to about 74 percent of GDP. In CBO's baseline, debt held by the public rises to about 78 percent of GDP in 2024.

What Proposals Would Have the Largest Budgetary Effects?

The President's budget contains many proposed changes to tax and spending policies. Over the 2015–2024 period, those policy changes would increase revenues by $1.4 trillion (or about 3 percent) and noninterest outlays by $446 billion (or 1 percent) relative to CBO's current-law baseline. Because deficits would be smaller than those projected in the baseline, those policy changes would also reduce interest payments by $108 billion (or 2 percent) over the 10- year period.

Among the policies proposed by the President, the ones with the largest estimated budgetary effects are the following:

- Less funding (relative to the amounts projected in CBO's baseline) for military operations in Afghanistan and for similar activities – known as overseas contingency operations. Following the rules specified in law, CBO's baseline incorporates the assumption that funding for such operations and activities each year through 2024 will equal the amount provided in 2014 – $92 billion – with increases in funding to keep pace with inflation. By comparison, the President's budget includes a request for $85 billion for those operations and activities in 2015, a “placeholder” amount of $30 billion in each year from 2016 through 2021, and nothing thereafter. Consequently, estimated outlays for overseas contingency operations under the President's proposal are $659 billion less over the 2015–2024 period than those in CBO's baseline.

- An increase in discretionary spending for all activities other than overseas contingency operations and surface transportation programs (which the President proposes to reclassify to the mandatory side of the budget). In total, projected outlays for those activities under the President's budget are $433 billion (or 4 percent) more over the 10-year projection period than those in CBO's baseline.

- A cap on the extent to which certain deductions and exclusions can reduce a taxpayer's income tax liability. The President's budget would limit the amount to no more than 28 percent of those deductions and exclusions; that change would increase revenues by $498 billion over the next decade, JCT estimates.

- Comprehensive immigration reform similar to the legislation that was passed by the Senate in 2013 – S. 744, the Border Security, Economic Opportunity, and Immigration Modernization Act. In July 2013, CBO and JCT estimated that, under the legislation, the number of legal residents and the size of the labor force would increase, boosting tax receipts and direct spending for federal benefit programs; the legislation would have various other economic and budgetary effects as well. CBO and JCT estimated that enacting S. 744 in 2013 would have, over the 2014–2023 period, increased revenues by $456 billion and raised direct spending by $298 billion, for a net reduction of $158 billion in the cumulative deficit. Because the Administration has not specified its proposal in detail, for this report CBO is using the Administration's placeholder figures for the budgetary effects of the proposal, which match CBO and JCT's estimates for S. 744 (but shifted forward one year).

- Net reductions in spending for Medicare. All together, proposed changes to Medicare would decrease federal spending by $250 billion over the 10-year projection period. The President's proposal to freeze payment rates for physicians (rather than allowing the rates to be reduced in 2015, as would be required under current law) would boost outlays by $124 billion. Other proposals affecting Medicare (excluding the cancellation of the automatic spending reductions) would reduce outlays by $373 billion, CBO estimates.

- Additional proposals in the President's budget include some initiatives that would widen the deficit and some that would narrow it. Those other proposals would change revenues and noninterest outlays by amounts that sum to a net increase of $190 billion in deficits over the 2015–2024 period.

How Do CBO's Estimates Differ From the Administration's?

CBO's estimates of budget deficits under the President's proposals are lower than the Administration's estimates for 2014 and 2015 but higher – by increasing amounts – between 2016 and 2024. The estimates of spending under the President's budget are very similar in total: CBO projects $174 billion less in outlays over the next 10 years than the Administration does, a difference of just 0.4 percent. CBO's projections of revenues under the President's budget are lower than the Administration's by a larger amount – $1.8 trillion, or about 4 percent; the bulk of that difference stems from the fact that CBO projects less revenues under current law than the Administration does, mostly because CBO estimates lower GDP, wages and salaries, and domestic economic profits over the 2015–2024 period.

In particular:

- For 2014, CBO's estimate of the deficit is $143 billion below what the Administration anticipates, almost entirely because of differing estimates of what will occur under current law. CBO estimates $111 billion less in spending and $32 billion more in revenues than does the Administration.

- For 2015, CBO's estimate of the deficit is $54 billion less than what the Administration anticipates because of differing estimates of outlays.

- Between 2016 and 2024, CBO estimates, the cumulative deficit under the President's proposals would total $6.1 trillion, which is $1.7 trillion more than the amount projected by the Administration.