Copper Journal Metals Report, 8/13/21

Where to Begin?

Last week was an odd one, no matter which way we looked at it.

Floods, fires, earthquakes, droughts, the virus getting worse around the world instead of better, political and military upheaval, rising inflation, threats to copper supplies, but new highs in global equity markets.

Taking the ‘Top Ten’ major equity markets first, with the exception of a minor loss in Brazil last week, all markets are higher on a year to date basis, as well as year over year – but the numbers are far from consistent. The S&P 500 notched new record highs in seven of the last 10 trading days, closing the week at 4,468, just about double from the low close of 2,237 on March 23, 2020 after the virus began spreading around the world. In fact, a number of markets are up 100% from that low point, or close to it including Germany, India, Brazil and Canada.

Notably absent from the list are China and Japan. Take a look at the charts, and you can see they are out of synch with the rest of the group, thereby raising cause for concern. One of the first observations of China’s Shanghai Composite is that it did not fall as fast, or as far as the other majors last year, and over the past year or so has been just vacillating around 3,500.

Also, while most other markets are up sharply, China is just marginally higher in comparison, and has been posting lower highs with each advance. This is not a great performance for the world’s second largest economy, and the largest consumer of copper. Indeed, in sharp contrast, year to date ‘apparent’ consumption of copper is running 9.6% ahead of last year. Perhaps their equity market is reflecting growing uncertainty about authorities exercising greater control over companies and industry sectors.

Japan on the other hand saw its high back in February, and has been posting lower highs and lower lows since then, with the year to date gain diminishing to just 1.9%. Japan is the world’s third largest economy, and the fourth largest consumer of copper. Unfortunately, copper usage there is off 8.4% from 2020 levels.

As for the other major equity markets, one is hard pressed to think they can continue rising indefinitely, but one is equally restrained from guessing where or when the top may occur. But occur it will, at some point.

In the red metal department, the good people at BHP’s Escondida mine were able to find the right middle ground in their labor negotiations, thereby averting a strike at the world’s largest copper mine. Last year Escondida produced 1.2 million metric tonnes of copper, representing about 5% of the global total. Regrettably, talks elsewhere in Chile between management and union members at Codelco’s Andina mine (184,000 mt), and the Caserones mine (126,000 mt) were unsuccessful, with both operations now on strike.

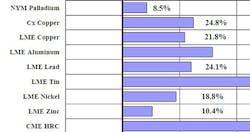

Base metals overall continue doing extremely well, with low and falling inventories, higher prices, and companies reporting record earnings. Tin remains the top performer in the nonferrous group as it continues reaching for the stars, and here too, one would be a fool to try guessing where the top will be.

Perhaps the biggest curiosity – to us anyway, is that the dollar rose above resistance at mid week, but by Friday was unable to sustain the advance. It still looks like it wants to move higher, so we’ll see what happens next week.