Understanding the HVAC residential replacement market is largely an exercise in history and math. Because I looked at history and math in 2020, I was alone in proclaiming 2020 would be a good year, despite COVID. Indeed, 2020 set a new record for shipments. Using the same approach, 2024 is likely to see additional contraction in the replacement market.

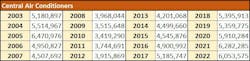

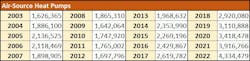

The Air-Conditioning, Heating, and Refrigeration Institute (AHRI) provides 20 years of industry shipment history. This takes most of the guesswork out of estimating the replacement market potential. Unitary air conditioners have an average life of 15 years. For heat pumps it is slightly less. For simplicity, we can lump them together and look back 15 years in the past to understand today’s market.

Looking Back

Until 2020, 2005 was the record year in the history of the industry. Shipments jumped 16% from the prior year, resulting in 8.6 million unitary air conditioners and heat pumps hitting the market. In 2019, the summer arrived late. When this happens, some replacements are deferred for a year. In an early summer or a very hot one, replacements are accelerated and pulled from the next year into the current one. So again, the result was 9.3 million units shipped in 2020, despite COVID and the resulting supply chain issues. The 9.3 million units included replacements and new construction.

After 2005, the industry contracted through 2009 and was flat in 2010. We went from 8.6 million units in 2005 down to 5.2 million in 2009 and 2010. This was a 40% contraction that is referred to as the shipment cliff. We plunged headlong into it in 2023 and will not emerge until late 2024 or 2025. Through November, shipments were down 16%. Remember, the shipment number includes new construction. Given that single family, detached housing starts grew by 140,000 in 2023 and multifamily grew by 103,000, the replacement market contraction was down closer to 24% for the year.

COVID did impact the cycle. There were a significant number of deferred replacements in 2020 that showed up in the first half of 2021. In the latter half of 2021 we began seeing early evidence of the shipment cliff, though it was largely hidden due to price increases. Because of the robust first half of the year, 2021 outpaced 2020 by 9%. In 2022, shipments were largely flat from 2021, finishing up nearly 2% and setting a new record.

The shipment cliff has more room to run. That is the history and the math. Contractors cannot replace what was not installed.

The replacement market is under additional stress due to the focus of private equity (PE) firms on change outs. PE was caught off guard by the shipment cliff and the finance types calling the shots on PE are not likely to fully comprehend that HVAC replacements will be in decline for another year or two. They are putting enormous pressure on their subsidiaries to sell change outs. But again, you cannot replace what was not installed 15 years ago, more or less.

Contractors looking to exit by selling to PE will find it tougher due to higher cost of capital for the PE firms. Prices for acquisitions should fall, but haven't so far (at least, not much). Buyers do appear to be more cautious about acquisitions. Deals are becoming harder to execute.

On the consumer side, people are dealing with a lot of fear, uncertainty, and doubt. Household budgets are strained. People are growing more worried about personal safety, which also makes them hold on to their wallets. We've had dramatic prices increases from Covid, SEER2, and expect another 20 to 25% from new A2L refrigerants. Many consumers will defer replacements and other expenses as long as possible. They will invest in affordable luxury and safety.

Some Hope From SERVICE

Service and replacement contractors need to get good at service. They need to make money at it. They cannot cut back on marketing and advertising. Smart contractors will get more aggressive and let the competition cut back and disappear while they take share.

Tumultuous times present opportunities. For example, when PE firms push out founders, many of their techs will be open to new opportunities. Failing competitors and contractors who get tired of the game will also present opportunities for tuck-in acquisitions that are too small to interest private equity.

This will be a time to focus on efficiencies. Watch the nickels without cutting muscle. Look for hidden profit opportunities such as improving call conversion. Tighten the service area to concentrate marketing. Package and bundle offerings, selling on payments, not total price.

Contractors looking to exit by selling to PE will find it tougher due to higher cost of capital for the PE firms.

This is also a time for contractors to expand their service offering. They can take advantage of consumer desires for safety and affordable luxury with connected home and security. It’s a natural extension with service agreements and ties the customer to the contractor even better. Another potential line extension is offering stand by generators. Interest is increasing as the grid is strained and more people experience blackouts.

Above all, contractors need to remember that they control their own destinies. They can decide whether to participate in any recession, or not. A deep recession is a 3% reduction in economic activity. HVAC contractors deal with seasonality that's far greater than that every year. Plus, all recessions end. Most are short.

RELATED CONTENT - 2024: Buckle Up!

We are in an El Nino, which despite the polar vortex means mild winters and hot summers. NOAA is forecasting a mild winder with more snow on the coast. The Tonga volcano last year increased atmospheric water vapor by 10%, which is huge. It explains why last summer was hot and why next summer and possibly the summer after that will also be hotter than normal.

Once we get past the shipment cliff, we can expect a 10-year run where demand will grow each year.

For help growing your business in tough times, band together with other contractors in the Service Roundtable. Learn more at www.ServiceRoundtable.com.

About the Author

Matt Michel

Chief Executive Officer

Matt Michel was a co-founder and CEO of the Service Roundtable (ServiceRoundtable.com). The Service Roundtable is an organization founded to help contractors improve their sales, marketing, operations, and profitability. The Service Nation Alliance is a part of this overall organization. Matt was inducted into the Contracting Business HVAC Hall of Fame in 2015. He is now an author and rancher.