The country is currently holding a national debate on tax rates. Contractors and other small business owners should pay attention. It’s like you debating whether to change your sales commission structure. That would matter for your salespeople. This matters for you.

The business incentive effect: Personal taxes have a strong impact on businesses because so many small businesses pay taxes as individuals if organized as an S-Corp, Limited Liability Corporation, or partnership (which pass business earnings through to the individual). This can create the appearance that a business owner has a high income. The truth is they actually pay themselves modest salaries and reinvest earnings in their business.

A study by Ernst & Young noted, “The increase in the top two income tax rates would directly affect nearly one million pass-through business owners, while another 1.2 million business owners earn enough to pay the top two rates, but are subject to the Alternative Minimum Tax instead.” That represents a significant number of the six million small businesses with a payroll, per the SBA.

Business owners may pay themselves a salary, but they really work on commission. The commission is the profitability of the company. Raising taxes lowers the commission. Think of the motivational effect you will achieve if you cut commissions on your salespeople. Raising taxes accomplishes the same for business owners. This is why the Ernst & Young study found that increasing marginal rates would result in fewer jobs, lower wages, less investment, and a smaller economy.

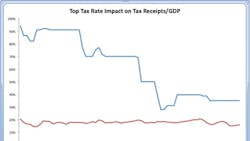

The Federal revenue effect: Since World War II, tax receipts as a percent of GDP have hovered in a narrow band between 16% and 20%, regardless of the marginal tax rates! Throughout the 1950s, the top marginal rate was 91%. Receipts averaged 17% of GDP.

The Kennedy tax cuts pulled rates down to 70%. After some fluctuation in the 1960s, rates were largely kept at 70% throughout the 1970s. Receipts averaged 18%.

The Reagan tax cuts pulled rates from 70% to 28% over the course of the 1980s. Receipts averaged 18%.

In 1990, GHW Bush raised marginal income taxes to 31%. In 1993, Clinton raised them to 39.6%. Receipts in the 1990s averaged 18%.

George W. Bush lowered marginal rates to 38.6% in 2001 and 35% in 2003, where they remain today. Tax receipts from 2000 through 2009 averaged 18%.

Do you see the pattern? When taxes go up, people find ways to legally avoid them and/or reduce their economic activity. Marginal investments become less attractive and aren’t made. Economic activity slows. When taxes are cut, more people get in the game, more investments are made, and the economy expands, generating greater tax receipts.

The corporate tax effect: Our corporate taxes are in even worse shape than personal taxes. They are the highest in the developed world. The highest! According to the accounting firm KPMG, combined Federal (35%) and state corporate taxes are 40%.

How does this compare? Canada and England are 26%. Germany is 29.48%. Communist China is 25%. Russia is 20%. France is 33.33%. Sweden is 26.3%. The European average is 20.6%. The global average is less than 24.47%

Many countries realize that tax policy affects investment, growth, and prosperity. This explains why most of them make their tax policy more business friendly. Of the countries that changed corporate tax rates since 2005, 78% lowered rates.

Strip ideology from the debate and there’s no debate at all. Empirically, it’s clear. Cutting taxes would increase economic growth, result in job formation, boost prosperity, and make America more competitive, while simultaneously increasing net government receipts.

Do you agree or disagree? Do you want more on economics? Let me know by emailing me at [email protected] or call toll free 877.262.3341.

Matt Michel is CEO of the Service Roundtable, which will pay contractors over $1 million in rebates on parts, supplies, equipment, consulting, software, books, and services. Call toll free 877/262.3341 to learn how much you can save with Roundtable Rewards.

About the Author

Matt Michel

Chief Executive Officer

Matt Michel was a co-founder and CEO of the Service Roundtable (ServiceRoundtable.com). The Service Roundtable is an organization founded to help contractors improve their sales, marketing, operations, and profitability. The Service Nation Alliance is a part of this overall organization. Matt was inducted into the Contracting Business HVAC Hall of Fame in 2015. He is now an author and rancher.